Dell 2006 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2006 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

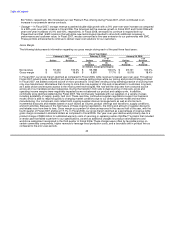

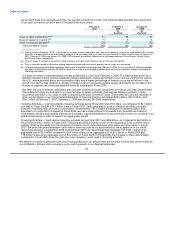

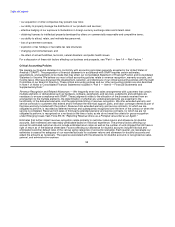

Contractual Cash Obligations

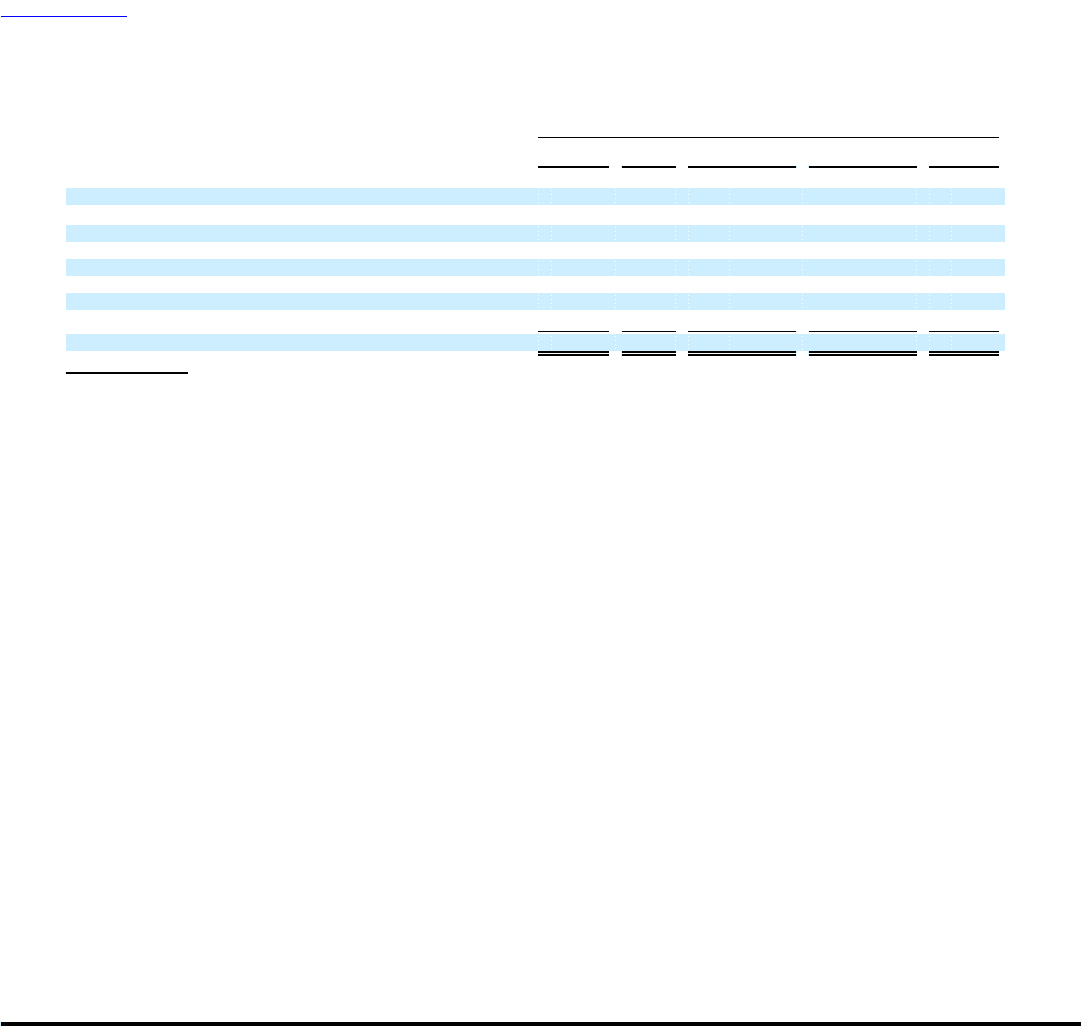

The following table summarizes our contractual cash obligations at February 2, 2007.

Payments Due by Period

Fiscal Fiscal 2009- Fiscal 2011-

Total 2008 2010 2012 Beyond

(in millions)

Contractual cash obligations:

Long-term debt, including current portion(b) $ 502 $ 1 $ 204 $ — $ 297

Operating leases 450 79 128 82 161

Advances under credit facilities 222 187 35 — —

Purchase obligations 570 532 38 — —

DFS purchase commitment 345 — 345 — —

Interest 590 73 129 43 345

Current portion of uncertain tax positions(a) 22 22 — — —

Contractual cash obligations $ 2,701 $ 894 $ 879 $ 125 $ 803

(a) The current portion of uncertain tax positions does not include approximately $1.1 billion in additional liabilities associated with uncertain tax

positions. We are unable to reliably estimate the expected payment dates for these additional liabilities.

(b) Changes in the fair value of the debt where the interest rate is hedged with interest rate swap agreements are not included in the contractual

cash obligations for debt as the debt is expected to be settled at par at its scheduled maturity date.

Long-Term Debt — At February 2, 2007, we had outstanding $200 million in Senior Notes with the principal balance due

April 15, 2008 and $300 million in Senior Debentures with the principal balance due April 15, 2028. For additional information

regarding these issuances, see Note 3 of Notes to Consolidated Financial Statements included in "Part II — Item 8 —

Financial Statements and Supplementary Data."

Concurrent with the issuance of the Senior Notes and Senior Debentures, we entered into interest rate swap agreements

converting our interest rate exposure from a fixed rate to a floating rate basis to better align the associated interest rate

characteristics to our cash and investments portfolio. The interest rate swap agreements have an aggregate notional amount

of $200 million maturing April 15, 2008 and $300 million maturing April 15, 2028. The floating rates are based on three-

month London Interbank Offered Rates plus 0.41% and 0.79% for the Senior Notes and Senior Debentures, respectively. As

a result of the interest rate swap agreements, our effective interest rates for the Senior Notes and Senior Debentures were

5.8% and 6.1%, respectively, for Fiscal 2007.

Operating Leases — We lease property and equipment, manufacturing facilities, and office space under non-cancellable

leases. Certain of these leases obligate us to pay taxes, maintenance, and repair costs.

Advances Under Credit Facilities — DFS maintains credit facilities with CIT that provide a maximum capacity of $750 million

to fund leased equipment. These borrowings are secured by DFS assets and contain certain customary restrictive

covenants. Interest on the outstanding loans is paid quarterly and calculated based on an average of the two- and three-year

U.S. Treasury Notes plus 4.45%. DFS is required to make quarterly principal payments if the value of the leased equipment

securing the loans is less than the outstanding principal balance. At February 2, 2007 and February 3, 2006, outstanding

advances from CIT totaled $122 million and $133 million, respectively, of which $87 million and $63 million, respectively, is

included in short-term borrowings and $35 million and $70 million, respectively, is included in long-term debt on our

Consolidated Statement of Financial Position. The credit facilities expire on the earlier of (i) the dissolution of DFS; (ii) the

purchase of CIT's ownership interest in DFS; or (iii) the acceleration of the maturity of the debt by CIT arising from a default.

During Fiscal 2007, we implemented a $1.0 billion commercial paper program with a supporting $1.0 billion senior unsecured

revolving credit facility. This program allows us to obtain favorable short-term borrowing rates. At February 2, 2007,

$100 million was outstanding under the commercial paper program and is included in short-term borrowings on our

Consolidated Statement of Financial Position.

52