DIRECTV 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

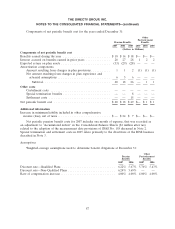

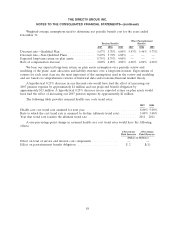

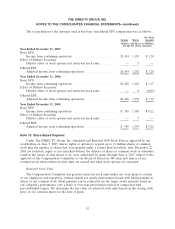

Components of net periodic benefit cost for the years ended December 31:

Other

Postretirement

Pension Benefits Benefits

2007 2006 2005 2007 2006 2005

(Dollars in Millions)

Components of net periodic benefit cost

Benefits earned during the year ........................... $18 $14 $18 $— $— $—

Interest accrued on benefits earned in prior years .............. 28 27 28 1 2 2

Expected return on plan assets ............................ (33) (29) (28) — — —

Amortization components

Amount resulting from changes in plan provisions ...........112(1)(1)(1)

Net amount resulting from changes in plan experience and

actuarial assumptions ..............................656———

Subtotal ...................................... 20 18 26 — 1 1

Other costs

Curtailment costs ..................................——————

Special termination benefits ........................... — — 8 — — —

Settlement costs ...................................——15———

Net periodic benefit cost ................................ $20 $18 $49 $— $ 1 $ 1

Additional information

Increase in minimum liability included in other comprehensive

income (loss), net of taxes .............................. $— $24 $ 7 $— $— $—

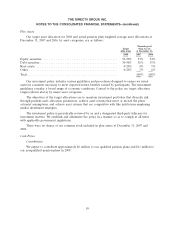

Net periodic pension benefit costs for 2007 includes one month of expense, that was recorded as

an adjustment to ‘‘Accumulated deficit’’ in the Consolidated Balance Sheets ($1 million after tax)

related to the adoption of the measurement date provisions of SFAS No. 158 discussed in Note 2.

Special termination and settlement costs in 2005 relate primarily to the divestiture of the HNS business

described in Note 3.

Assumptions

Weighted-average assumptions used to determine benefit obligations at December 31:

Other

Pension Postretirement

Benefits Benefits

2007 2006 2007 2006

Discount rate—Qualified Plans .............................. 6.22% 5.67% 5.76% 5.43%

Discount rate—Non-Qualified Plans ........................... 6.24% 5.69% — —

Rate of compensation increase ............................... 4.00% 4.00% 4.00% 4.00%

87