DIRECTV 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

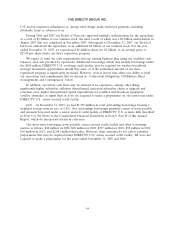

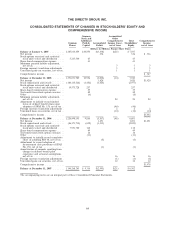

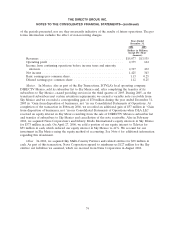

THE DIRECTV GROUP, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY AND

COMPREHENSIVE INCOME

Common Accumulated

Stock and Other

Additional Comprehensive Total Comprehensive

Common Paid-In Accumulated Income (Loss), Stockholders’ Income,

Shares Capital Deficit net of taxes Equity net of taxes

(Dollars in Millions, Except Share Data)

Balance at January 1, 2005 ......... 1,385,814,459 $10,870 $(3,338) $(25) $ 7,507

Net income ................... 336 336 $ 336

Stock options exercised and restricted

stock units vested and distributed .... 5,217,530 45 45

Share-based compensation expense .... 41 41

Minimum pension liability adjustment,

net of tax ................... 7 7 7

Foreign currency translation adjustments . 3 3 3

Unrealized gains on securities, net of tax . 1 1 1

Comprehensive income ............ $ 347

Balance at December 31, 2005 ....... 1,391,031,989 10,956 (3,002) (14) 7,940

Net income ................... 1,420 1,420 $1,420

Stock repurchased and retired ........ (184,115,524) (1,452) (1,525) (2,977)

Stock options exercised and restricted

stock units vested and distributed .... 19,573,728 257 257

Share-based compensation expense .... 39 39

Tax benefit from stock option exercises . . 42 42

Other ....................... (6) (6)

Minimum pension liability adjustment,

net of tax ................... 24 24 24

Adjustment to initially record funded

status of defined benefit plans upon

adoption of SFAS No. 158, net of tax . . (46) (46)

Foreign currency translation adjustments . 2 2 2

Unrealized losses on securities, net of tax . . (14) (14) (14)

Comprehensive income ............ $1,432

Balance at December 31, 2006 ....... 1,226,490,193 9,836 (3,107) (48) 6,681

Net Income ................... 1,451 1,451 $1,451

Stock repurchased and retired ........ (86,173,710) (692) (1,333) (2,025)

Stock options exercised and restricted

stock units vested and distributed .... 7,951,720 118 118

Share-based compensation expense .... 49 49

Tax benefit from stock option exercises . . 18 18

Other ....................... (11) (11)

Adjustment to initially record cumulative

effect of adopting FIN 48, net of tax . . (5) (5)

Adjustment to record adoption of

measurement date provisions of SFAS

No. 158, net of tax ............. (1) (1)

Amortization of amounts resulting from

changes in defined benefit plan

experience and actuarial assumptions,

net of tax ................... 16 16 16

Foreign currency translation adjustments . (1) (1) (1)

Unrealized gains on securities, net of tax . 12 12 12

Comprehensive income ............ $1,478

Balance at December 31, 2007 ....... 1,148,268,203 $ 9,318 $(2,995) $(21) $ 6,302

The accompanying notes are an integral part of these Consolidated Financial Statements.

64