DIRECTV 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

Note 15: Related-Party Transactions

In the ordinary course of our operations, we enter into transactions with related parties. News

Corporation and its affiliates are considered related parties because News Corporation owns

approximately 41% of our outstanding common stock. Companies in which we hold equity method

investments are also considered related parties, which include Sky Mexico from the acquisition on

February 16, 2006. We have the following types of contractual arrangements with our related parties:

purchase of programming, products and advertising; license of certain intellectual property, including

patents; purchase of system access products, set-top receiver software and support services; sale of

advertising space; purchase of employee services; and use of facilities. The majority of payments under

contractual arrangements with News Corporation entities relate to multi-year programming contracts.

Payments under these contracts are typically subject to annual rate increases and are based on the

number of subscribers receiving the related programming.

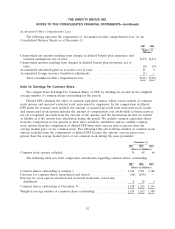

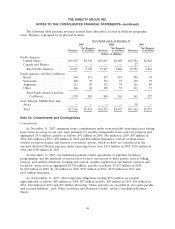

The following table summarizes sales and purchase transactions with related parties:

2007 2006 2005

(Dollars in Millions)

Sales ................................................ $ 24 $ 32 $ 18

Purchases ............................................. 1,124 832 707

The following table sets forth the amount of assets and liabilities resulting from transactions with

related parties as of December 31:

2007 2006

(Dollars in

Millions)

Accounts receivable ............................................ $ 22 $ 11

Accounts payable .............................................. 285 206

The accounts receivable and accounts payable balances as of December 31, 2007 and 2006 are

primarily related to affiliates of News Corporation. Accounts receivable as of December 31, 2007

includes $11 million for costs incurred on behalf of a News Corporation entity, which will be

reimbursed pursuant to a reimbursement agreement.

In addition to the transactions described above, in connection with our purchase of News

Corporation’s interests as part of the Sky Transactions, we made cash payments to News Corporation of

$315 million in 2006. We received $127 million in cash from News Corporation in August 2006 for the

repayment of a note receivable for the assumption of certain liabilities as part of the Sky Transactions

described in Note 3.

Note 16: Derivative Financial Instruments and Risk Management

Our cash flows and earnings are subject to fluctuations resulting from changes in foreign currency

exchange rates, interest rates and changes in the market value of our equity investments. We manage

our exposure to these market risks through internally established policies and procedures and, when

deemed appropriate, through the use of derivative financial instruments. We enter into derivative

instruments only to the extent considered necessary to meet our risk management objectives, and do

not enter into derivative contracts for speculative purposes. As of December 31, 2007 and

December 31, 2006, we had no significant foreign currency or interest related derivative financial

instruments outstanding.

96