DIRECTV 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

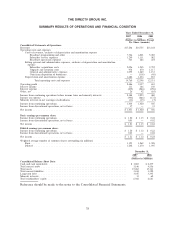

THE DIRECTV GROUP, INC.

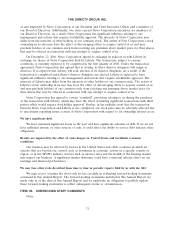

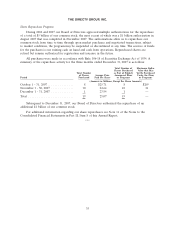

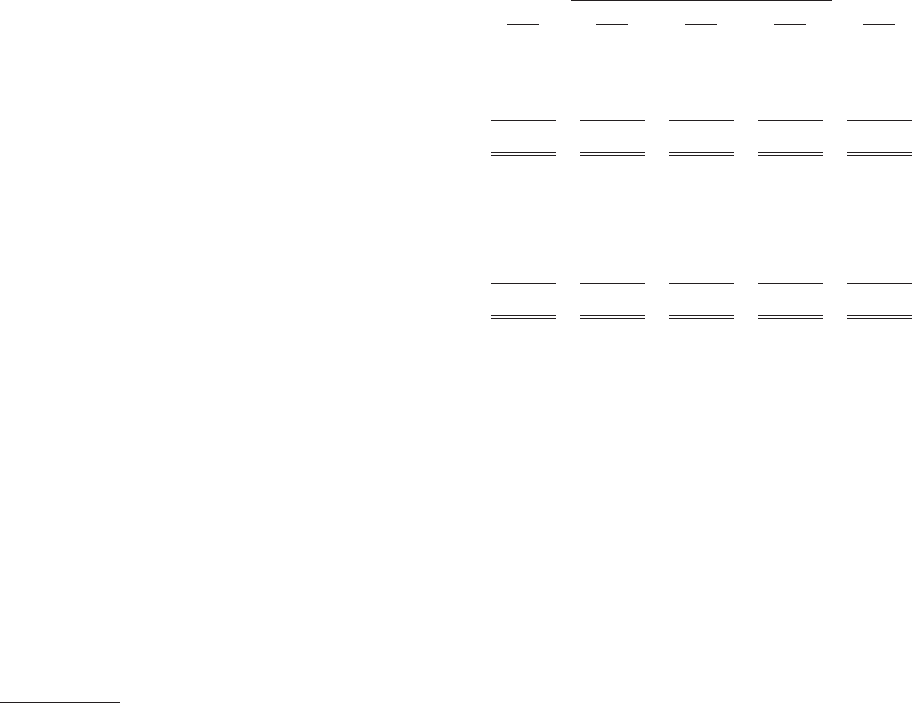

ITEM 6. SELECTED FINANCIAL DATA

Years Ended and As of December 31,

2007 2006 2005 2004 2003

(Dollars in Millions, Except Per Share Amounts)

Consolidated Statements of Operations Data:

Revenues ................................ $17,246 $14,755 $13,164 $11,360 $ 9,372

Total operating costs and expenses .............. 14,760 12,398 12,531 13,479 9,510

Operating profit (loss) ...................... $ 2,486 $ 2,357 $ 633 $(2,119) $ (138)

Income (loss) from continuing operations before

cumulative effect of accounting changes ........ $ 1,434 $ 1,420 $ 305 $(1,056) $ (375)

Income (loss) from discontinued operations, net of

taxes ................................. 17 — 31 (582) 78

Cumulative effect of accounting changes, net of taxes — — — (311) (65)

Net income (loss) .......................... $ 1,451 $ 1,420 $ 336 $(1,949) $ (362)

Basic earnings (loss) per common share:

Income (loss) from continuing operations before

cumulative effect of accounting changes ........ $ 1.20 $ 1.13 $ 0.22 $ (0.77) $ (0.27)

Diluted earnings (loss) per common share:

Income (loss) from continuing operations before

cumulative effect of accounting changes ........ $ 1.20 $ 1.12 $ 0.22 $ (0.77) $ (0.27)

Weighted average number of common shares

outstanding (in millions):

Basic ................................... 1,195 1,262 1,388 1,385 1,383

Diluted ................................. 1,202 1,270 1,395 1,385 1,383

Consolidated Balance Sheet Data:

Total assets .............................. $15,063 $15,141 $15,630 $14,324 $19,037

Long-term debt ........................... 3,347 3,395 3,405 2,410 2,435

Total stockholders’ equity .................... 6,302 6,681 7,940 7,507 9,631

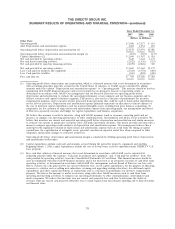

In 2003, the $65 million cumulative effect of accounting change, net of taxes, was due to our adoption

of Financial Accounting Standards Board, or FASB, Interpretation No. 46, ‘‘Consolidation of Variable

Interest Entities—an interpretation of ARB No. 51’’, or FIN 46 on July 1, 2003, and related to the

consolidation of certain DIRECTV Latin America entities. Income from discontinued operations

recorded in 2003 includes the results of our former PanAmSat and Hughes Software Systems, or HSS,

businesses, which we sold in 2004.

In 2004, total operating costs and expenses include a $1.466 billion charge recorded for the impairment

of SPACEWAY assets. Also in 2004, we recorded income from discontinued operations related to the

results of operations and the sale of our PanAmSat and HSS businesses, which we sold in 2004. The

$311 million cumulative effect of accounting change, net of taxes, in 2004 was due to DIRECTV U.S.

changing its method of accounting for subscriber acquisition, upgrade and retention costs.

See the Notes to the Consolidated Financial Statements and Management’s Discussion and Analysis of

Financial Condition and Results of Operations for additional information regarding other significant

transactions during each of the three years in the period ended December 31, 2007.

***

36