DIRECTV 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

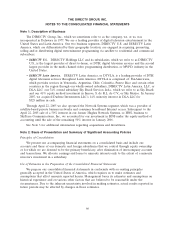

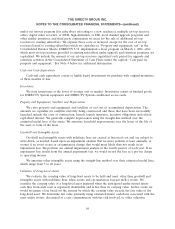

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

assets, financial liabilities and firm commitments. Under this standard, unrealized gains and losses on

items for which the fair value option is elected are reported in earnings at each subsequent reporting

date. We do not expect the adoption of SFAS No. 159 on January 1, 2008 to have any effect on our

consolidated results of operations or financial position.

In September 2006, the FASB issued SFAS No. 157, ‘‘Fair Value Measurements.’’ SFAS No. 157

defines fair value, sets out a framework for measuring fair value in generally accepted accounting

principles, and expands disclosures about fair value measurements of assets and liabilities. SFAS

No. 157 applies under other accounting pronouncements previously issued by the FASB that require or

permit fair value measurements. We do not expect the adoption of SFAS No. 157 on January 1, 2008 to

have any effect on our consolidated results of operations or financial position.

In September 2006, the Emerging Issues Task Force, or EITF, issued EITF No. 06-1, ‘‘Accounting

for Consideration Given by a Service Provider to a Manufacturer or Reseller of Equipment Necessary

for an End-Customer to Receive Service from the Service Provider.’’ EITF No. 06-1 provides guidance

to service providers regarding the proper reporting of consideration given to manufacturers or resellers

of equipment necessary for an end-customer to receive its services. Depending on the circumstances,

such consideration is reported as either an expense or a reduction of revenues. We do not expect the

adoption of EITF No. 06-1 on January 1, 2008 to have any effect on our consolidated results of

operations.

Note 3: Acquisitions, Divestitures and Other Transactions

Acquisitions

Darlene Transaction

On January 30, 2007, we acquired Darlene’s 14% equity interest in DLA LLC for $325 million in

cash. We accounted for the acquisition of this interest using the purchase method of accounting. In the

fourth quarter of 2007, we completed the valuation of acquired intangible assets and finalized the

purchase accounting, which resulted in adjustments decreasing the preliminary allocation of the

purchase price to the acquired intangible assets by $30 million, goodwill by $9 million and deferred tax

liabilities by $39 million.

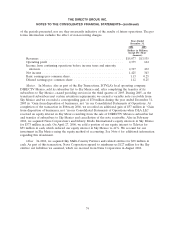

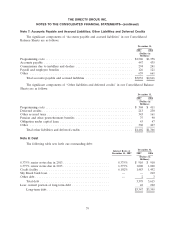

The following table set forth the final allocation of the excess purchase price over the book value

of the minority interest acquired:

Goodwill ......................................................... $187

Intangible assets .................................................... 75

Total assets acquired ................................................. 262

Net assets acquired ................................................ $262

Intangible assets that are included in ‘‘Intangible assets, net’’ in our Consolidated Balance Sheets

include a subscriber related intangible asset to be amortized over six years and a trade name intangible

asset to be amortized over 20 years from the Darlene Transaction.

Sky Transactions

During 2006 we completed the last in a series of transactions with News Corporation, Grupo

Televisa, S.A., or Televisa, Globo Comunicacoes e Participacoes S.A., or Globo, and Liberty Media

72