DIRECTV 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

tax assets will be realized in the ordinary course of operations based on the available positive and

negative evidence, including the scheduling of deferred tax liabilities and forecasted income from

operating activities. The underlying assumptions we use in forecasting future taxable income require

significant judgment. In the event that actual income from operating activities differs from forecasted

amounts, or if we change our estimates of forecasted income from operating activities, we could record

additional charges in order to adjust the carrying value of deferred tax assets to their realizable

amount. Such charges could be material to our consolidated results of operations and financial position.

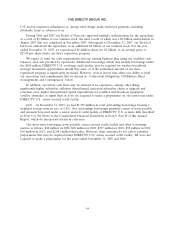

In addition, the recognition of a tax benefit for tax positions involves dealing with uncertainties in

the application of complex tax regulations. Judgment is required in assessing the future tax

consequences of events that have been recognized in our financial statements or tax returns. We

provide for taxes for uncertain tax positions where assessments have not been received in accordance

with FIN 48. We believe such tax reserves are adequate in relation to the potential for additional

assessments. Once established, we adjust these amounts only when more information is available or

when an event occurs necessitating a change to the reserves. Future events such as changes in the facts

or law, judicial decisions regarding the application of existing law or a favorable audit outcome will

result in changes to the amounts provided.

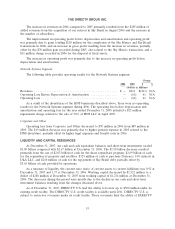

Contingent Matters. Determining when, or if, an accrual should be recorded for a contingent

matter, including but not limited to legal and tax issues, and the amount of such accrual, if any,

requires a significant amount of management judgment and estimation. We develop our judgment and

estimates in consultation with outside counsel based on an analysis of potential outcomes. Due to the

uncertainty of determining the likelihood of a future event occurring and the potential financial

statement impact of such an event, it is possible that upon further development or resolution of a

contingent matter, we could record a charge in a future period that would be material to our

consolidated results of operations and financial position.

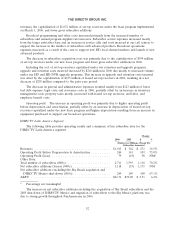

Valuation of Long-Lived Assets. We evaluate the carrying value of long-lived assets to be held and

used, other than goodwill and intangible assets with indefinite lives, when events and circumstances

warrant such a review. We consider the carrying value of a long-lived asset impaired when the

anticipated undiscounted future cash flow from such asset is separately identifiable and is less than its

carrying value. In that event, we recognize a loss based on the amount by which the carrying value

exceeds the fair value of the long-lived asset. We determine fair value primarily using the estimated

future cash flows associated with the asset under review, discounted at a rate commensurate with the

risk involved, and other valuation techniques. We determine losses on long-lived assets to be disposed

of in a similar manner, except that we reduce the fair value for the cost of disposal. Changes in

estimates of future cash flows could result in a write-down of the asset in a future period.

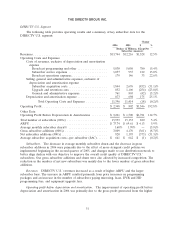

Depreciable Lives of Leased Set-Top Receivers. We currently lease most set-top receivers provided

to new and existing subscribers and therefore capitalize the cost of those set-top receivers. We

depreciate capitalized set-top receivers at DIRECTV U.S. over a three year estimated useful life, which

is based on, among other things, management’s judgment of the risk of technological obsolescence.

Changes in the estimated useful lives of set-top receivers capitalized could result in significant changes

to the amounts recorded as depreciation expense. Based on the book value of DIRECTV U.S.’ set-top

receivers capitalized as of December 31, 2007, if we extended the depreciable life of the set-top

receivers by one half of a year, it would result in an approximately $120 million reduction in annual

depreciation expense.

Valuation of Goodwill and Intangible Assets with Indefinite Lives. We evaluate the carrying value of

goodwill and intangible assets with indefinite lives annually in the fourth quarter or more frequently

when events and circumstances change that would more likely than not result in an impairment loss.

57