DIRECTV 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

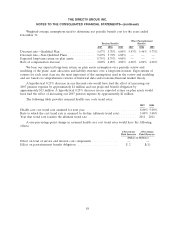

Treasury yield curve in effect at the time of grant. The expected option life is based on historical

exercise behavior and other factors.

2007

Estimated fair value per option granted .................................. $ 8.27

Average exercise price per option granted ................................ 22.43

Expected stock volatility ............................................. 22.5%

Risk-free interest rate ............................................... 4.65%

Expected option life (in years) ........................................ 7.0

There were no stock options granted during the years ended December 31, 2006 and 2005.

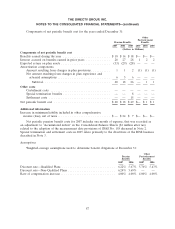

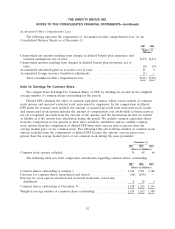

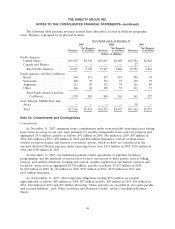

The following table presents amounts recorded related to share-based compensation:

For the Year Ended

December 31,

2007 2006 2005

(Dollars in Millions)

Share-based compensation expense recognized ........................... $ 49 $ 39 $41

Tax benefits associated with share-based compensation expense ............... 19 15 16

Actual tax benefits realized for the deduction of share-based compensation

expense ..................................................... 36 50 17

Proceeds received from stock options exercised .......................... 118 257 45

The 2005 stock compensation costs include the cost of options granted to our CEO to replace

stock options that News Corporation, his former employer, cancelled, and the cost associated with

former employees of News Corporation who retained their News Corporation stock options and are

now employed by us.

As of December 31, 2007, there was $67 million of total unrecognized compensation expense

related to unvested restricted stock units and stock options that we expect to recognize as follows:

$37 million in 2008, $24 million in 2009 and $6 million in 2010.

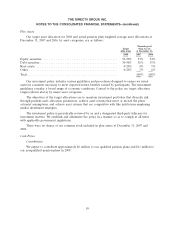

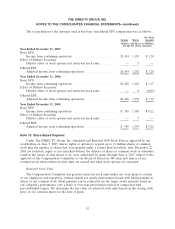

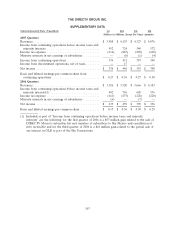

Note 14: Other Income and Expenses

The following table summarizes the components of ‘‘Other, net’’ in our Consolidated Statements of

Operations for the years ended December 31:

2007 2006 2005

(Dollars in Millions)

Equity in earnings from unconsolidated affiliates .......................... $35 $27 $ 1

Net (loss) gain from sale of investments ................................ (6) 14 (1)

Refinancing transaction expenses ..................................... — — (65)

Other ......................................................... (3) 1 —

Total other, net ............................................... $26 $42 $(65)

During 2005, DIRECTV U.S. completed a series of refinancing transactions that resulted in a

pre-tax charge of $65 million ($40 million after tax), of which $41 million was associated with the

premium paid for the redemption of a portion of our 8.375% senior notes and $24 million with the

write-off of a portion of our deferred debt issuance costs and other transaction costs.

See Note 6 regarding equity method investments and net gains and losses recorded on the sale of

investments.

95