DIRECTV 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

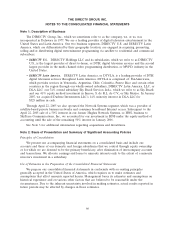

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

Defined Benefit Postretirement Plans. On December 31, 2007, we adopted the measurement date

provision of SFAS No. 158, ‘‘Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans—an amendment of FASB Statements No. 87, 88, 106, and 132(R).’’ This provision

requires the measurement of plan assets and benefit obligations as of the date of our fiscal year end

and accordingly resulted in a change in our measurement date, which was previously November 30. As

a result of the adoption of this provision, we recorded an adjustment of $1 million to recognize net

periodic benefit cost for the one month difference to ‘‘Accumulated deficit’’ in the Consolidated

Balance Sheets as of December 31, 2007.

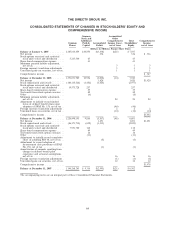

On December 31, 2006, we adopted the provisions of SFAS No. 158 that require us to recognize

the funded status of our defined benefit postretirement plans in our Consolidated Balance Sheets and

require that we recognize changes in the funded status of our defined benefit postretirement plans as a

component of other comprehensive income, net of tax, in stockholders’ equity in the Consolidated

Balance Sheets, in the year in which changes occur. The adoption of the provisions to recognize the

funded status of our benefit plans resulted in a $46 million decrease in ‘‘Accumulated other

comprehensive income’’ in our Consolidated Statements of Changes in Stockholders’ Equity and

Comprehensive Income as of December 31, 2006.

Share-Based Payment. On January 1, 2006, we adopted SFAS No. 123R ‘‘Share-Based Payment.’’

The adoption of this standard did not have a significant effect in our consolidated results of operations

or financial position. However, as a result of the adoption of SFAS. No. 123R, we now report the

excess income tax benefit associated with the exercise of stock options or pay-out of restricted stock

units as a cash flow from financing activities in the Consolidated Statements of Cash Flows.

New Accounting Standards

In December 2007, the FASB issued SFAS No.160, ‘‘Noncontrolling Interests in Consolidated

Financial Statements—an amendment to ARB No. 51.’’ SFAS No. 160 establishes standards of

accounting and reporting of noncontrolling interests in subsidiaries, currently known as minority

interests, in consolidated financial statements, provides guidance on accounting for changes in the

parent’s ownership interest in a subsidiary and establishes standards of accounting of the

deconsolidation of a subsidiary due to the loss of control. SFAS No.160 requires an entity to present

minority interests as a component of equity. Additionally, SFAS No. 160 requires an entity to present

net income and consolidated comprehensive income attributable to the parent and the minority interest

separately on the face of the consolidated financial statements. We are currently assessing the effect

SFAS No. 160 will have on our consolidated results of operations and financial position when adopted,

as required, on January 1, 2009.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), ‘‘Business Combinations.’’ SFAS

No. 141R requires the acquiring entity to recognize and measure at an acquisition date fair value all

identifiable assets acquired, liabilities assumed and any noncontrolling interest in the acquiree. The

Statement recognizes and measures the goodwill acquired in the business combination or a gain from a

bargain purchase. SFAS No. 141R requires disclosures about the nature and financial effect of the

business combination and also changes the accounting for certain income tax assets recorded in

purchase accounting. We are currently assessing the effect SFAS No. 141R will have on our

consolidated results of operations and financial position when adopted, as required, on January 1, 2009.

In February 2007, the FASB issued SFAS No. 159, ‘‘The Fair Value Option for Financial Assets

and Financial Liabilities—Including an amendment of FASB Statement No. 115.’’ SFAS No. 159

permits, but does not require, companies to report at fair value the majority of recognized financial

71