DIRECTV 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

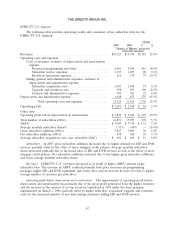

EXECUTIVE OVERVIEW AND OUTLOOK

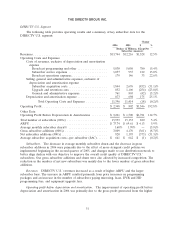

The following discussion of revenues and operating results relates to DIRECTV U.S., which

generates 90% of our revenues.

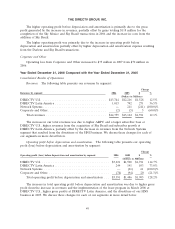

Revenues. In 2007, DIRECTV U.S. revenues increased by 13.0% due to a larger subscriber base

and a 7.2% increase in ARPU. In 2008, we anticipate revenues will increase by over 10.0% due to an

increase in total subscribers and ARPU growth of 5.0% or more. ARPU increases are primarily

expected to be driven by price increases and higher penetration of advanced products. After accounting

for churn, our net new subscriber additions in 2007 were 878,000 which increased our total subscriber

base by 5.5% to 16.8 million customers. In 2008, we expect net new subscriber additions to decrease

due to the anticipated reduction in the number of subscribers added through our RBOC distributors as

well as churn on the larger cumulative subscriber base.

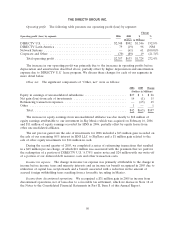

Operating Results. In 2007, DIRECTV U.S. operating profit before depreciation and amortization

increased 19.5% to $3,850 million and operating profit before depreciation and amortization margin

improved from 23.4% in 2006 to 24.8% in 2007, primarily due to the gross profit generated from the

higher revenues and an increase in the amount of set-top receivers capitalized in 2007 under the lease

program introduced on March 1, 2006, partially offset by higher subscriber acquisition, upgrade and

retention costs due to the increased number of new and existing subscribers adding HD and DVR

services.

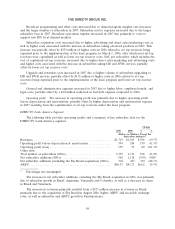

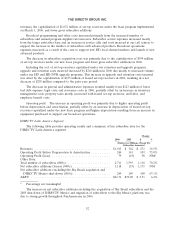

In 2008, we expect both operating profit before depreciation and amortization and operating profit

before depreciation and amortization margin to increase. These improvements are anticipated to be

due to the expected increase in revenues and improvements in most of our significant cost categories

due to greater cost controls, scale and efficiencies.

In 2007, operating profit increased 2.3% to $2,402 million primarily due to higher operating profit

before depreciation and amortization, partially offset by an increase in depreciation of leased set-top

receivers capitalized under the new lease program and higher depreciation resulting from an increase in

equipment purchased to support our broadcast operations. Operating profit in 2008 is expected to

increase as the anticipated higher operating profit before depreciation and amortization is expected to

be only partially offset by higher depreciation and amortization expense resulting from the set-top

receiver lease program.

Free Cash Flow. In 2007, The DIRECTV Group generated $953 million of free cash flow, defined

as net cash provided by operating activities less cash paid for property and satellites. During 2008, we

expect significant free cash flow growth as a result of the anticipated increase in operating profit before

depreciation and amortization and a decrease in capital expenditures for leased set top receivers,

satellite construction and broadcast equipment to support our HD ground infrastructure. We anticipate

these increases to be partially offset by a significant increase in cash paid for income taxes due mostly

to the utilization of our net operating loss carryforwards in 2007.

44