DIRECTV 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

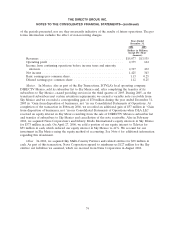

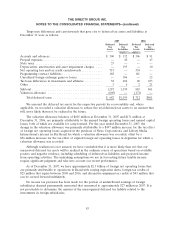

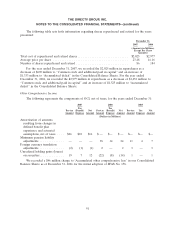

Temporary differences and carryforwards that gave rise to deferred tax assets and liabilities at

December 31 were as follows:

2007 2006

Deferred Deferred Deferred Deferred

Tax Tax Ta x Tax

Assets Liabilities Assets Liabilities

(Dollars in Millions)

Accruals and advances .............................. $ 300 $ 132 $306 $ 91

Prepaid expenses .................................. — 40 — 43

State taxes ...................................... 23 — — —

Depreciation, amortization and asset impairment charges .... — 193 — 10

Net operating loss and tax credit carryforwards ............ 715 — 354 —

Programming contract liabilities ....................... 188 — 181 —

Unrealized foreign exchange gains or losses .............. — 106 — 23

Tax basis differences in investments and affiliates .......... 58 682 40 673

Other .......................................... 3 6 2 21

Subtotal ........................................ 1,287 1,159 883 861

Valuation allowance ............................... (605) — (171) —

Total deferred taxes ............................ $ 682 $1,159 $ 712 $861

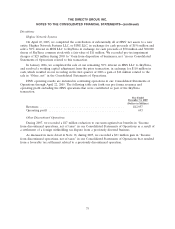

We assessed the deferred tax assets for the respective periods for recoverability and, where

applicable, we recorded a valuation allowance to reduce the total deferred tax assets to an amount that

will, more likely than not, be realized in the future.

The valuation allowance balances of $605 million at December 31, 2007 and $171 million at

December 31, 2006, are primarily attributable to the unused foreign operating losses and unused capital

losses, both of which are available for carry-forward. For the year ended December 31, 2007, the

change in the valuation allowance was primarily attributable to a $497 million increase for the tax effect

of foreign net operating losses acquired in the purchase of News Corporation’s and Liberty Media

International’s interest in Sky Brazil for which a valuation allowance was recorded, offset by a

$56 million decrease for the tax effect of expired foreign net operating losses in Argentina for which a

valuation allowance was recorded.

Although realization is not assured, we have concluded that it is more likely than not that our

unreserved deferred tax assets will be realized in the ordinary course of operations based on available

positive and negative evidence, including scheduling of deferred tax liabilities and projected income

from operating activities. The underlying assumptions we use in forecasting future taxable income

require significant judgment and take into account our recent performance.

As of December 31, 2007, we have approximately $2.3 billion of foreign net operating losses that

are primarily attributable to operations in Brazil with varying expiration dates, foreign tax credits of

$25 million that expire between 2008 and 2016, and alternative minimum tax credits of $43 million that

can be carried forward indefinitely.

No income tax provision has been made for the portion of undistributed earnings of foreign

subsidiaries deemed permanently reinvested that amounted to approximately $27 million in 2007. It is

not practicable to determine the amount of the unrecognized deferred tax liability related to the

investments in foreign subsidiaries.

83