DIRECTV 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

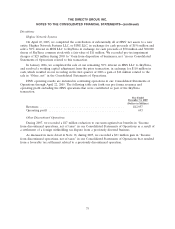

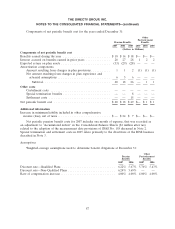

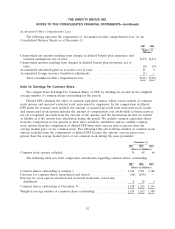

The components of the pension benefit obligation and the other postretirement benefit obligation,

including amounts recognized in the Consolidated Balance Sheets, are shown below for the years ended

December 31:

Other

Pension Postretirement

Benefits Benefits

2007 2006 2007 2006

(Dollars in Millions)

Change in Net Benefit Obligation

Net benefit obligation at beginning of year ..................... $468 $488 $ 28 $ 26

Service cost ............................................ 18 14 — —

Interest cost ............................................ 28 27 1 2

Plan participants’ contributions .............................. 1 1 — —

Actuarial loss (gain) ...................................... (27) 13 (3) 2

Plan amendments ........................................ — — — —

Benefits paid ........................................... (58) (75) (2) (2)

Net benefit obligation at end of year .......................... 430 468 24 28

Change in Plan Assets

Fair value of plan assets at beginning of year .................... 393 356 — —

Actual return on plan assets ................................ 22 45 — —

Employer contributions .................................... 11 67 2 2

Plan participants’ contributions .............................. — — — —

Benefits paid ........................................... (58) (75) (2) (2)

Fair value of plan assets at end of year ........................ 368 393 — —

Funded status at end of year ................................ $(62) $(75) $(24) $(28)

Amounts recognized in the consolidated balance sheets consist of:

Investments and other assets ............................ $ 2 $ — $— $—

Accounts payable and accrued liabilities .................... (10) (10) (3) (3)

Other liabilities and deferred credits ....................... (54) (65) (21) (25)

Deferred tax assets ................................... 26 34 (1) —

Accumulated other comprehensive loss ..................... 42 57 (1) 1

Amounts recognized in the accumulated other comprehensive loss

consist of:

Unamortized net amount resulting from changes in defined benefit

plan experience and actuarial assumptions, net of taxes ....... $ 37 $ 51 $— $ 2

Unamortized amount resulting from changes in defined benefit

plan provisions, net of taxes ........................... 5 6 (1) (1)

Total .......................................... $ 42 $ 57 $ (1) $ 1

85