DIRECTV 2007 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

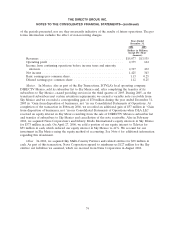

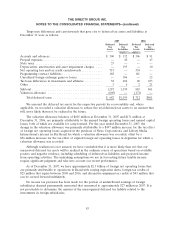

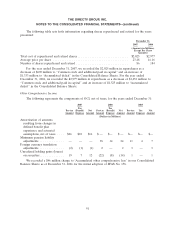

A reconciliation of the beginning and ending balances of the total amounts of gross unrecognized

tax benefits, excluding accrued interest, is as follows (in millions):

Gross unrecognized tax benefits at January 1, 2007 ........................... $159

Increases in tax positions for prior years .................................. 102

Increases in tax positions for current year ................................. 34

Settlements ....................................................... (4)

Gross unrecognized tax benefits at December 31, 2007 ........................ $291

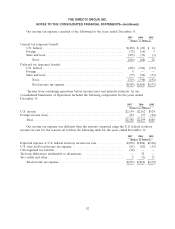

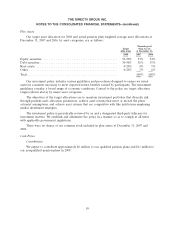

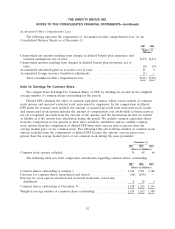

As of December 31, 2007, our unrecognized tax benefits totaled $343 million, including accrued

interest of $52 million. If our tax positions are ultimately sustained by the tax authorities in our favor,

approximately $212 million would reduce the annual effective income tax rate.

We recorded $17 million of interest in ‘‘Income tax expense’’ in the Consolidated Statement of

Operations during the year ended December 31, 2007 for unrecognized tax benefits.

We file numerous consolidated and separate income tax returns in the U.S. federal jurisdiction and

in many state and foreign jurisdictions. For U.S. federal tax purposes, the tax years 2001 through 2007

remain open to examination. The California tax years 1994 through 2007 remain open to examination

and the income tax returns in the other state and foreign tax jurisdictions in which we have operations

are generally subject to examination for a period of 3 to 5 years after filing of the respective return.

We anticipate that the examination of the federal income tax returns for 2001 through 2003 will

conclude in 2008 and the statute of limitations will be closing in a foreign jurisdiction in the next twelve

months resulting in an estimated reduction in our unrecognized tax benefits of approximately

$45 million, $28 million of which relates to discontinued operations. We do not anticipate that other

changes to the total unrecognized tax benefits in the next twelve months will have a significant effect

on our results of operations or financial position.

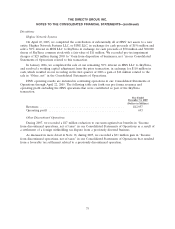

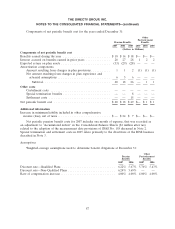

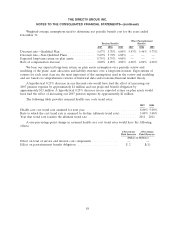

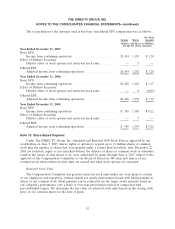

Note 10: Pension and Other Postretirement Benefit Plans

Most of our employees are eligible to participate in our funded non-contributory defined benefit

pension plan, which provides defined benefits based on either years of service and final average salary,

or eligible compensation while employed by the company. Additionally, we maintain a funded

contributory defined benefit plan for employees who elected to participate prior to 1991, and an

unfunded, nonqualified pension plan for certain eligible employees. For participants in the contributory

pension plan, we also maintain a postretirement benefit plan for those eligible retirees to participate in

health care and life insurance benefits generally until they reach age 65. Participants may become

eligible for these health care and life insurance benefits if they retire from our company between the

ages of 55 and 65. The health care plan is contributory with participants’ contributions subject to

adjustment annually; the life insurance plan is non-contributory.

On December 31, 2007, we adopted the measurement date provision of SFAS No. 158,

‘‘Employers’ Accounting for Defined Benefit Pension and Other Postretirement Plans—an amendment

of FASB Statements No. 87, 88, 106, and 132(R).’’ This provision requires the measurement of plan

assets and benefit obligations as of the date of our fiscal year end. This required a change in our

measurement date, which was previously November 30. See Note 2 for additional information.

84