DIRECTV 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS—(continued)

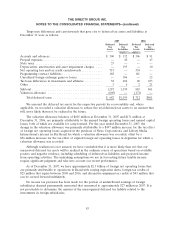

Divestitures

Hughes Network Systems

On April 22, 2005, we completed the contribution of substantially all of HNS’ net assets to a new

entity, Hughes Network Systems LLC, or HNS LLC, in exchange for cash proceeds of $196 million and

sold a 50% interest in HNS LLC to SkyTerra in exchange for cash proceeds of $50 million and 300,000

shares of SkyTerra common stock with a fair value of $11 million. We recorded pre-tax impairment

charges of $25 million during 2005 to ‘‘Gain from disposition of businesses, net ‘‘in our Consolidated

Statements of Operations related to this transaction.

In January 2006, we completed the sale of our remaining 50% interest in HNS LLC to SkyTerra,

and resolved a working capital adjustment from the prior transaction, in exchange for $110 million in

cash, which resulted in our recording in the first quarter of 2006 a gain of $14 million related to the

sale in ‘‘Other, net’’ in the Consolidated Statements of Operations.

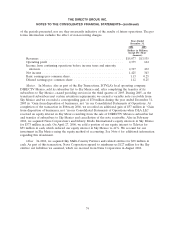

HNS’ operating results are included in continuing operations in our Consolidated Statements of

Operations through April 22, 2005. The following table sets forth our pro forma revenues and

operating profit excluding the HNS operations that were contributed as part of the SkyTerra

transaction.

Year Ended

December 31, 2005

(Dollars in Millions)

Revenues ................................................ $12,957

Operating profit ........................................... 693

Other Discontinued Operations

During 2007, we recorded a $17 million reduction to our unrecognized tax benefits in ‘‘Income

from discontinued operations, net of taxes’’ in our Consolidated Statements of Operations as a result of

a settlement of a foreign withholding tax dispute from a previously divested business.

As discussed in more detail in Note 18, during 2005, we recorded a $31 million gain in ‘‘Income

from discontinued operations, net of taxes’’ in our Consolidated Statements of Operations that resulted

from a favorable tax settlement related to a previously discontinued operation.

75