DIRECTV 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

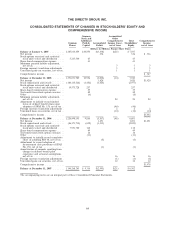

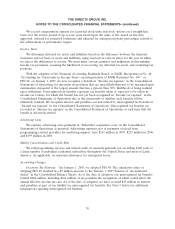

THE DIRECTV GROUP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31,

2007 2006 2005

(Dollars in Millions)

Cash Flows From Operating Activities

Net income ...................................................... $1,451 $ 1,420 $ 336

Income from discontinued operations, net of taxes ............................. (17) — (31)

Income from continuing operations ....................................... 1,434 1,420 305

Adjustments to reconcile income from continuing operations to net cash provided by operating

activities:

Depreciation and amortization ........................................ 1,684 1,034 853

Amortization of deferred revenues and deferred credits ........................ (98) (41) (47)

Gain from disposition of businesses, net .................................. — (118) (45)

Equity in earnings from unconsolidated affiliates ............................. (35) (27) (1)

Net loss (gain) from sale or impairment of investments ......................... 9 (14) 1

Loss on disposal of fixed assets ........................................ 8 20 3

Share-based compensation expense ..................................... 49 39 41

Write-off of debt issuance costs ........................................——19

Deferred income taxes and other ....................................... 453 770 188

Change in operating assets and liabilities:

Accounts and notes receivable ....................................... (166) (283) (130)

Inventories ................................................... (45) 139 (159)

Prepaid expenses and other ......................................... 46 (12) (35)

Accounts payable and accrued liabilities ................................. 255 158 312

Unearned subscriber revenue and deferred credits .......................... 72 2 15

Other, net .................................................... (21) 75 (148)

Net cash provided by operating activities ............................... 3,645 3,162 1,172

Cash Flows From Investing Activities

Purchase of short-term investments ....................................... (588) (2,517) (4,673)

Sale of short-term investments .......................................... 748 3,029 4,512

Cash paid for property and equipment ..................................... (2,523) (1,754) (489)

Cash paid for satellites .............................................. (169) (222) (400)

Investment in companies, net of cash acquired ................................ (348) (389) (1)

Proceeds from sale of investments ....................................... — 182 113

Proceeds from collection of notes receivable ................................. — 142 —

Proceeds from sale of property ......................................... 33 13 —

Proceeds from sale of businesses, net ..................................... — — 246

Other, net ...................................................... 25 (20) (31)

Net cash used in investing activities .................................. (2,822) (1,536) (723)

Cash Flows From Financing Activities

Common shares repurchased and retired ................................... (2,025) (2,977) —

Repayment of long-term debt .......................................... (220) (8) (2,005)

Long-term debt borrowings ............................................ — — 3,003

Net increase (decrease) in short-term borrowings .............................. 2 (2) (2)

Repayment of other long-term obligations .................................. (121) (100) (91)

Debt issuance costs ................................................. — — (5)

Stock options exercised .............................................. 118 257 45

Excess tax benefit from share-based compensation ............................. 7 2 —

Net cash (used in) provided by financing activities ......................... (2,239) (2,828) 945

Net (decrease) increase in cash and cash equivalents ............................. (1,416) (1,202) 1,394

Cash and cash equivalents at beginning of the year .............................. 2,499 3,701 2,307

Cash and cash equivalents at end of the year .................................. $1,083 $ 2,499 $ 3,701

Supplemental Cash Flow Information

Cash paid for interest ............................................... $ 230 $ 243 $ 240

Cash paid for income taxes ............................................ 408 30 13

The accompanying notes are an integral part of these Consolidated Financial Statements.

65