DIRECTV 2005 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

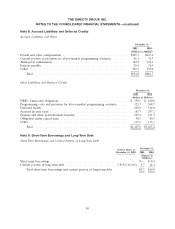

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

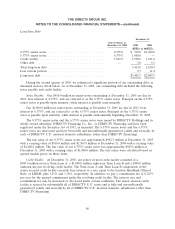

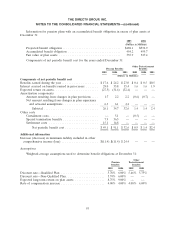

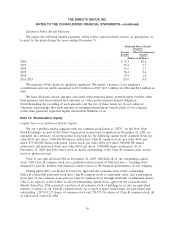

Long-Term Debt

December 31,

Interest Rates at

December 31, 2005 2005 2004

(Dollars in Millions)

8.375% senior notes ................................ 8.375% $ 910.0 $1,400.0

6.375% senior notes ................................ 6.375% 1,000.0 —

Credit facility ..................................... 5.813% 1,500.0 1,011.8

Other debt ....................................... — 5.0 9.1

Total long-term debt ................................ 3,415.0 2,420.9

Less current portion ................................ 9.7 11.4

Long-term debt .................................... $3,405.3 $2,409.5

During the second quarter of 2005, we refinanced a significant portion of our outstanding debt, as

discussed in more detail below. As of December 31, 2005, our outstanding debt included the following

notes payable and credit facility:

Notes Payable. Our $910.0 million in senior notes outstanding at December 31, 2005 are due in

2013, bear interest at 8.375%, and are referred to as the 8.375% senior notes. Principal on the 8.375%

senior notes is payable upon maturity, while interest is payable semi-annually.

Our $1,000.0 million in senior notes outstanding at December 31, 2005 are due in 2015, bear

interest at 6.375%, and are referred to as the 6.375% senior notes. Principal on the 6.375% senior

notes is payable upon maturity, while interest is payable semi-annually beginning December 15, 2005.

The 8.375% senior notes and the 6.375% senior notes were issued by DIRECTV Holdings and its

wholly owned subsidiary, DIRECTV Financing Co., Inc., or DIRECTV Financing, and have been

registered under the Securities Act of 1933, as amended. The 8.375% senior notes and the 6.375%

senior notes are unsecured and have been fully and unconditionally guaranteed, jointly and severally, by

each of DIRECTV U.S.’ material domestic subsidiaries (other than DIRECTV Financing).

The fair value of our 8.375% senior notes was approximately $982.3 million at December 31, 2005

with a carrying value of $910.0 million and $1,569.8 million at December 31, 2004 with a carrying value

of $1,400.0 million. The fair value of our 6.375% senior notes was approximately $983.8 million at

December 31, 2005 with a carrying value of $1,000.0 million. The fair values were calculated based on

quoted market prices on those dates.

Credit Facility. At December 31, 2005, our senior secured credit facility consisted of a

$500.0 million six-year Term Loan A, a $1,000.0 million eight-year Term Loan B and a $500.0 million

undrawn six-year revolving credit facility. The Term Loan A and Term Loan B components of the

senior secured credit facility currently bear interest at a rate equal to the London InterBank Offered

Rate, or LIBOR, plus 1.25% and 1.50%, respectively. In addition, we pay a commitment fee of 0.225%

per year for the unused commitment under the revolving credit facility. The interest rate and

commitment fee may be increased or decreased under certain conditions. The senior secured credit

facility is secured by substantially all of DIRECTV U.S.’ assets and is fully and unconditionally

guaranteed, jointly and severally by all of DIRECTV U.S.’ material domestic subsidiaries (other than

DIRECTV Financing).

86