DIRECTV 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

• On June 22, 2004, we completed the sale of HNS’ set-top receiver manufacturing operations to

Thomson for $250 million in cash. In connection with the sale, DIRECTV U.S. entered into a

long-term purchase agreement with Thomson for the supply of set-top receivers. The proceeds in

excess of the book value of the HNS assets sold of approximately $200 million were deferred

and are being recognized as set-top receivers purchased from Thomson under the contract are

activated.

• During 2004, we sold various equity investments for $510.5 million in cash and recorded a

pre-tax gain of $396.5 million in ‘‘Other, net’’ in our Consolidated Statements of Operations.

The financial results for PanAmSat, which formerly comprised our Satellite Services segment, and

HSS, which was formerly a component of our Network Systems segment, are presented in our

Consolidated Statements of Operations as discontinued operations. As a result of the SkyTerra

transaction, subsequent to April 22, 2005, we accounted for our investment in HNS under the equity

method of accounting, and accordingly, recorded our interest in HNS’ net income in ‘‘Other, net’’ in

our Consolidated Statements of Operations.

For additional information regarding the actions described above, see Note 3 and Note 5 of the

Notes to the Consolidated Financial Statements in Part II, Item 8, of this Annual Report.

Other Developments

In addition to the items described above, the following events had a significant effect on the

comparability of our operating results for the years ended December 31, 2005, 2004 and 2003:

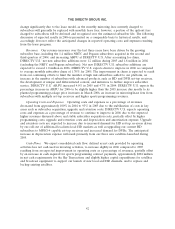

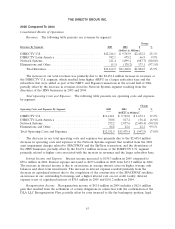

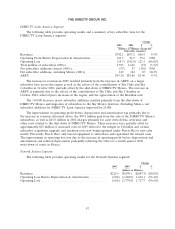

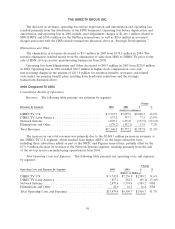

DIRECTV U.S.

Hurricanes Katrina, Wilma, and Rita. During the second half of 2005, a series of hurricanes

devastated certain portions of the Gulf Coast region of the United States. As a result, we recorded

approximately $24 million in charges mostly related to a higher level of service calls resulting from the

hurricanes, a reduction in revenues for subscriber service credits and an increase in bad debt expense.

Approximately 10,000 subscribers were disconnected in 2005 resulting from the hurricanes.

Financing Transactions. During the second quarter of 2005, DIRECTV U.S. completed a series of

refinancing transactions that resulted in a pre-tax charge to ‘‘Other, net’’ in our Consolidated

Statements of Operations of $64.9 million ($40.0 million after tax), of which $41.0 million was

associated with the premium that we paid for the redemption of a portion of our 8.375% senior notes

and $23.9 million with our write-off of a portion of our deferred debt issuance costs and other

transaction costs. As a result of the refinancing transactions, our long-term debt increased by

$1,011.7 million during 2005 and cash, net of the premium paid and transaction costs, increased

$966.0 million. See Note 9 of the Notes to the Consolidated Financial Statements in Part II, Item 8 of

this Annual Report for further discussion of these refinancing transactions.

During 2003, DIRECTV U.S. raised approximately $2,625.0 million of cash through the issuance of

$1,400.0 million of 8.375% senior notes and $1,225.0 million of borrowings under a credit facility. We

used a portion of these proceeds to repay the $506.3 million outstanding principal balance plus accrued

interest under a prior credit facility agreement, which then terminated.

Accounting Change. Effective January 1, 2004, DIRECTV U.S. changed its method of accounting

for subscriber acquisition, upgrade and retention costs. Previously, DIRECTV U.S. deferred a portion

of these costs, equal to the amount of profit to be earned from the subscriber, typically over the

12 month subscriber contract, and amortized the deferred amounts to expense over the contract period.

DIRECTV U.S. now expenses subscriber acquisition, upgrade and retention costs as incurred as

38