DIRECTV 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

PART II

ITEM 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

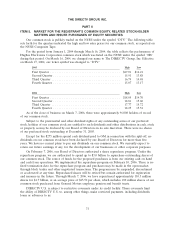

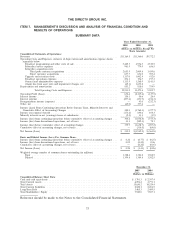

Our common stock is publicly traded on the NYSE under the symbol ‘‘DTV.’’ The following table

sets forth for the quarters indicated the high and low sales prices for our common stock, as reported on

the NYSE Composite Tape.

For the period from January 1, 2004 through March 16, 2004, the table reflects the performance of

Hughes Electronics Corporation common stock which was listed on the NYSE under the symbol ‘‘HS’’

during that period. On March 16, 2004, we changed our name to The DIRECTV Group, Inc. Effective

on March 17, 2004, our ticker symbol was changed to ‘‘DTV.’’

2005 High Low

First Quarter ........................................ $17.01 $14.21

Second Quarter ...................................... 15.91 13.88

Third Quarter ....................................... 16.79 14.48

Fourth Quarter ...................................... 15.07 13.17

2004 High Low

First Quarter ........................................ $18.05 $14.70

Second Quarter ...................................... 18.81 15.60

Third Quarter ....................................... 17.77 15.72

Fourth Quarter ...................................... 18.25 15.52

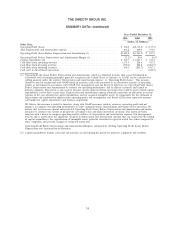

As of the close of business on March 7, 2006, there were approximately 96,008 holders of record

of our common stock.

Subject to the preferential and other dividend rights of any outstanding series of our preferred

stock, holders of our common stock are entitled to such dividends and other distributions in cash, stock

or property as may be declared by our Board of Directors in its sole discretion. There were no shares

of our preferred stock outstanding at December 31, 2005.

Except for the $275 million special cash dividend paid to GM in connection with the split-off, no

dividends on our common stock have been declared by our Board of Directors for more than five

years. We have no current plans to pay any dividends on our common stock. We currently expect to

retain our future earnings, if any, for the development of our businesses or other corporate purposes.

On February 7, 2006, our Board of Directors authorized a share repurchase program. Under the

repurchase program, we are authorized to spend up to $3.0 billion to repurchase outstanding shares of

our common stock. The source of funds for the proposed purchases is from our existing cash on hand

and cash from operations. We implemented the repurchase program on February 10, 2006. There is no

fixed termination date for the repurchase program and purchases may be made in the open market,

through block trades and other negotiated transactions. The program may be suspended, discontinued

or accelerated at any time. Repurchased shares will be retired but remain authorized for registration

and issuance in the future. Through March 7, 2006, we have repurchased approximately 110.3 million

shares for $1.7 billion, at an average price of $15.50 per share, which includes 100 million shares of our

common stock purchased from General Motors employee pension and benefit trusts.

DIRECTV U.S. is subject to restrictive covenants under its credit facility. These covenants limit

the ability of DIRECTV U.S. to, among other things, make restricted payments, including dividends,

loans or advances to us.

31