DIRECTV 2005 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

Operations at the time such determination is made. See Note 3 of the Notes to the Consolidated

Financial Statements in Part II, Item 8 of this Annual Report for further discussion.

ACCOUNTING CHANGE

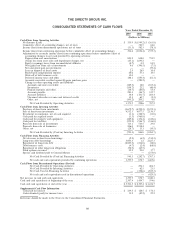

Subscriber Acquisition, Upgrade and Retention Costs. Effective January 1, 2004, we changed our

method of accounting for subscriber acquisition, upgrade and retention costs. Previously, we deferred a

portion of these costs, equal to the amount of profit to be earned from the subscriber, typically over

the 12 month subscriber contract, and amortized to expense over the contract period. We now expense

subscriber acquisition, upgrade and retention costs as incurred as subscribers activate the DIRECTV

service. We determined that expensing such costs was preferable to the prior accounting method after

considering the accounting practices of competitors and companies within similar industries and the

added clarity and ease of understanding our reported results for investors. We continue to capitalize

costs under our subscriber lease programs. As a result of the change, on January 1, 2004, we expensed

our deferred subscriber acquisition cost balance of $503.9 million as a cumulative effect of accounting

change. The amount of the cumulative effect was $310.5 million, net of taxes. The following table

presents our results on a pro forma basis as if we had retroactively applied this new method:

2005 2004 2003

(Dollars in Millions, Except Per Share

and Per Subscriber Amounts)

Pro Forma:

Total operating costs and expenses .......................... $12,531.9 $13,479.4 $9,599.0

Operating Profit (Loss) .................................. 632.6 (2,119.4) (226.8)

Net income (loss) ...................................... 335.9 (1,638.7) (416.8)

Basic and diluted net income (loss) per common share ........... 0.24 (1.18) (0.30)

Other Data:

Operating Profit (Loss) .................................. $ 632.6 $(2,119.4) $ (226.8)

Add: Depreciation and amortization expense .................. 853.2 838.0 754.9

Operating Profit (Loss) before depreciation and amortization ...... $ 1,485.8 $(1,281.4) $ 528.1

Average subscriber acquisition costs—per subscriber (SAC) ........ $ 642 $ 643 $ 604

For addition information regarding ‘‘Accounting Changes’’ and ‘‘New Accounting Standards,’’ see

Note 2 of the Notes to the Consolidated Financial Statements in Part II, Item 8 of this Annual Report,

which we incorporate herein by reference.

SECURITY RATINGS

Debt ratings by the various rating agencies reflect each agency’s opinion of the ability of issuers to

repay debt obligations as they come due. Ratings in the Ba range for Moody’s Investor Services, or

Moody’s, and the BB range for Standard & Poor’s Ratings Services, or S&P, generally indicate

moderate protection of interest and principal payments, potentially outweighed by exposure to

uncertainties or adverse conditions. Ratings in the B range generally indicate that the obligor currently

has financial capacity to meet its financial commitments but there is limited assurance over any long

period of time that interest and principal payments will be made or that other terms will be

maintained. In general, lower ratings result in higher borrowing costs. A security rating is not a

recommendation to buy, sell, or hold securities and may be subject to revision or withdrawal at any

time by the assigning rating organization.

59