DIRECTV 2005 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

As part of the sale of our interest in PanAmSat, we agreed to indemnify PanAmSat for certain

taxes related to periods ending on or prior to the day of the closing in amounts equal to 80% of the

first $75.0 million of such taxes and 100% of any such taxes in excess of the first $75.0 million.

PanAmSat has outstanding tax claims relating to withholding taxes assessed on revenues derived from

broadcasters inside and outside of India who broadcast from or into India. These claims would be

subject to the indemnification provided by us. The Indian government has assessed approximately

$7.3 million against one of the PanAmSat subsidiaries for the Indian tax year ended March 31, 1997.

This assessment is being appealed to the Income Tax Appeals Tribunal. For the Indian tax years ended

March 31, 1996 through 2002, the Indian government has assessed approximately $44.4 million in the

aggregate against PanAmSat, including interest. This assessment has been appealed to the

Commissioner of Income Tax (Appeals). PanAmSat is contesting the imposition of such taxes. If

unsuccessful in its contest, PanAmSat could be subject to comparable claims for subsequent years,

which would include additional years covered by the indemnification agreement.

While the outcome of these and other tax issues cannot be predicted with certainty, we believe

that the ultimate outcome will not have a material adverse effect on our consolidated results of

operations or financial position.

Satellites

We may purchase in-orbit and launch insurance to mitigate the potential financial impact of

satellite fleet launch and in-orbit failures if the premium costs are considered economic relative to the

risk of satellite failure. The insurance generally covers the unamortized book value of covered satellites.

We do not insure against lost revenues in the event of a total or partial loss of the capacity of a

satellite. We generally rely on in-orbit spare satellites and excess transponder capacity at key orbital

slots to mitigate the impact a satellite failure could have on our ability to provide service. At

December 31, 2005, the net book value of uninsured satellites amounted to $605.7 million.

Other

We are contingently liable under standby letters of credit and bonds in the aggregate amount of

$16.2 million which were undrawn at December 31, 2005.

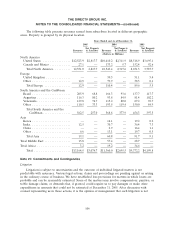

At December 31, 2005, minimum future commitments under noncancelable operating leases having

lease terms in excess of one year were primarily for satellite transponder leases and real property and

aggregated $610.9 million, payable as follows: $90.4 million in 2006, $90.2 million in 2007, $81.7 million

in 2008, $67.9 million in 2009, $69.6 million in 2010 and $211.1 million thereafter. Certain of these

leases contain escalation clauses and renewal or purchase options. Rental expenses under operating

leases, net of sublease income, were $108.8 million in 2005, $180.5 million in 2004 and $177.3 million in

2003.

We have minimum commitments under noncancelable satellite construction and launch contracts,

programming agreements, telemetry, tracking and control services, or TT&C, services agreements,

billing system agreements, customer call center maintenance agreements and other vendor obligations.

As of December 31, 2005, minimum payments over the terms of applicable contracts are anticipated to

be approximately $5,094.2 million, payable as follows: $911.0 million in 2006, $997.5 million in 2007,

$944.2 million in 2008, $889.4 million in 2009, $887.1 million in 2010 and $465.0 million thereafter.

The DLA LLC Second Amended and Restated Limited Liability Company Agreement, as

amended in February 2004, or the DLA LLC Agreement, provides Darlene the right, under certain

circumstances, to require us to purchase all of Darlene’s equity interests in DLA LLC for

108