DIRECTV 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

We account for investments in which we own at least 20% of the voting securities or have

significant influence under the equity method of accounting. We record equity method investments at

cost and adjust for the appropriate share of the net earnings or losses of the investee. We record

investee losses up to the amount of the investment plus advances and loans made to the investee, and

financial guarantees made on behalf of the investee.

The carrying value of cash and cash equivalents, short-term investments, accounts and notes

receivable, investments and other assets, accounts payable, and amounts included in accrued liabilities

and other meeting the definition of a financial instrument or debt approximated their fair values at

December 31, 2005 and 2004.

Debt Issuance Costs

We defer costs we incur to issue debt and amortize these costs to interest expense using the

straight-line method over the term of the respective obligation.

Stock-Based Compensation

We grant restricted stock units and common stock options to our employees. For grants and

modifications of awards on or after January 1, 2003, we recognize compensation expense equal to the

fair value of the stock-based award at grant over the course of its vesting period following Statement of

Financial Accounting Standards, or SFAS, No. 123, ‘‘Accounting for Stock-Based Compensation,’’ as

amended. We accounted for stock options, restricted stock units and other stock-based awards granted

prior to January 1, 2003 under the intrinsic value method of Accounting Principles Board, or APB,

Opinion No. 25, ‘‘Accounting for Stock Issued to Employees.’’ However, due to the completion of the

News Corporation transactions on December 22, 2003, all awards were modified and therefore, all

awards are now accounted for under the fair value based method.

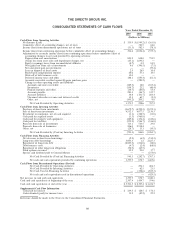

The following table presents the effect on loss from continuing operations before cumulative effect

of accounting change of recognizing compensation cost as if the fair value based method had been

applied to all outstanding and unvested stock options and restricted stock units for the year ended

December 31:

2003

(Dollars in

Millions, Except

Per Share

Amounts)

Reported Income (loss) from continuing operations before cumulative effect of

accounting changes .......................................... $(375.3)

Add: Stock compensation cost, net of taxes, included above .............. 11.9

Deduct: Total stock compensation cost, net of taxes, under the fair value based

method .................................................. (107.8)

Pro forma Income (loss) from continuing operations before cumulative effect

of accounting changes ........................................ $(471.2)

Basic and diluted income (loss) from continuing operations before cumulative

effect of accounting changes per common share:

Reported ............................................... $ (0.27)

Pro forma ............................................... (0.34)

72