DIRECTV 2005 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

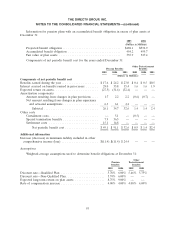

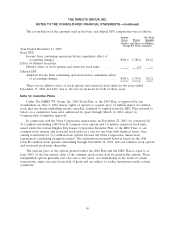

The Compensation Committee has also granted restricted stock units that vest over two to four

years under the 2004 Plan and the HEC Plan. During the year ended December 31, 2005, the

Compensation Committee granted 3.0 million restricted stock units with a weighted average grant-date

fair value of approximately $16.61 per share. During the year ended December 31, 2004, the

Compensation Committee granted 4.4 million restricted stock units with a weighted average grant-date

fair value of approximately $17.46 per share. During the year ended December 31, 2003, the

Compensation Committee granted 3.6 million restricted stock units with a weighted average grant-date

fair value of approximately $10.71 per share. At December 31, 2005, there were 7.6 million unvested

restricted stock units with a weighted average grant-date fair value of approximately $16.03.

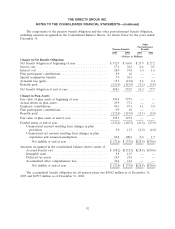

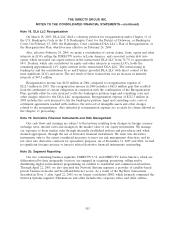

Note 15: Other, Net

The following table summarizes the components of ‘‘Other, net’’ for the years ended December 31:

2005 2004 2003

(Dollars in Millions)

Equity in earnings (losses) from unconsolidated affiliates ............... $ 0.7 $ (0.2) $(81.5)

Net unrealized gain on investments ............................... — — 79.4

Net (loss) gain from sale of investments ........................... (0.6) 396.5 7.5

Refinancing transaction expenses ................................ (64.9) — —

Other .................................................... (0.2) 1.3 (5.4)

Total Other, net ........................................... $(65.0) $397.6 $ —

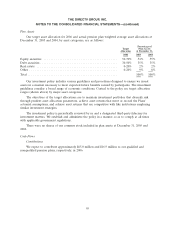

During 2005, DIRECTV U.S. completed a series of refinancing transactions that resulted in a

pre-tax charge of $64.9 million ($40.0 million after tax), of which $41.0 million was associated with the

premium paid for the redemption of a portion of our 8.375% senior notes and $23.9 million with the

write-off of a portion of our deferred debt issuance costs and other transaction costs.

During 2005, we sold an equity investment for $113.1 million in cash. As a result, we recognized a

net pre-tax loss of $0.6 million during 2005.

During 2004, we sold various equity investments for $510.5 million in cash and recorded a pre-tax

gain of $396.5 million.

For the year ended December 31, 2003, equity losses from unconsolidated affiliates are primarily

comprised of losses at the DTVLA LOCs.

Net unrealized gain on investments for 2003 includes a $79.6 million gain resulting from an

increase in the fair market value of an investment in a convertible note.

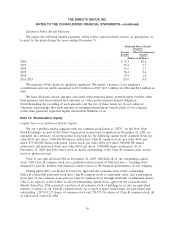

Note 16: Severance, Retention and Pension Benefit Costs

During the first quarter of 2004, we announced the reduction of corporate office headcount by

over half as a result of our plan to consolidate corporate and DIRECTV U.S. support functions. There

were also additional headcount reductions at DIRECTV U.S. and at DTVLA. As a result of the

completion of the News Corporation transactions on December 22, 2003, certain of our employees

earned retention benefits during the twelve month period subsequent to the completion of the

transactions. As a result of these items and the strategic transactions described above and in Note 3, we

recognized $169.5 million in charges for retention benefits, severance and related costs under our

101