DIRECTV 2005 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

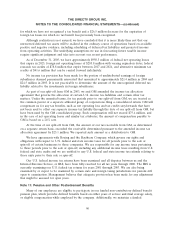

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

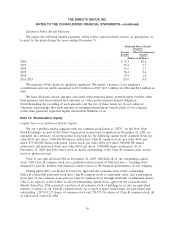

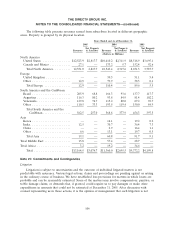

Changes in the status of outstanding options were as follows:

Shares Under Weighted-Average

Option Exercise Price

Outstanding at January 1, 2003 ............................... 95,080,832 $23.16

Granted ............................................... 25,000 16.35

Exercised ............................................... (1,780,076) 10.15

Terminated ............................................. (2,164,436) 28.73

Outstanding at December 31, 2003 ............................ 91,161,320 23.28

Granted ............................................... 1,883,764 18.80

Exercised ............................................... (2,139,782) 10.72

Terminated ............................................. (1,971,186) 26.45

Outstanding at December 31, 2004 ............................ 88,934,116 23.42

Granted ............................................... — —

Exercised ............................................... (4,170,758) 10.83

Terminated ............................................. (6,048,852) 17.80

Outstanding at December 31, 2005 ............................ 78,714,506 24.52

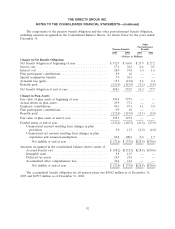

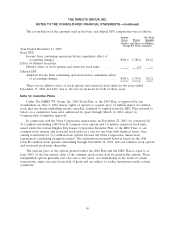

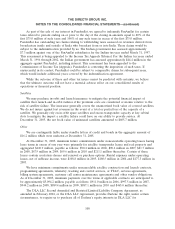

The following table summarizes information about stock options outstanding at December 31,

2005:

Options Outstanding Options Exercisable

Weighted-

Average Weighted- Weighted-

Remaining Average Average

Range of Number Contractual Exercise Number Exercise

Exercise Prices Outstanding Life (years) Price Exercisable Price

$9.00 to $16.99 20,090,642 2.4 $ 12.71 20,090,642 $12.71

17.00 to 24.99 20,322,637 5.0 19.80 20,322,637 19.80

25.00 to 32.99 16,080,804 5.0 27.77 16,080,804 27.77

33.00 to 41.99 22,220,423 4.3 37.16 22,220,423 37.16

78,714,506 2.9 24.52 78,714,506 24.52

Of the options outstanding at December 31, 2004 there were 88.9 million options exercisable at a

weighted average exercise price of $23.42, and of the options outstanding at December 31, 2003, there

were 87.6 million options exercisable at a weighted average price of $23.40.

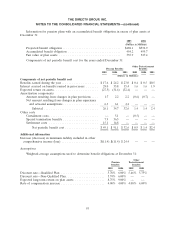

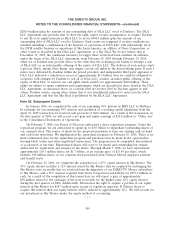

The following table presents the estimated weighted average fair value for stock options granted

under the Plan using the Black-Scholes valuation model along with the assumptions used in the fair

value calculations:

2004 2003

Estimated fair value per option granted ........................... $ 5.82 $ 8.80

Average exercise price per option granted ......................... 18.80 16.35

Expected stock volatility ...................................... 30.0% 47.2%

Risk-free interest rate ........................................ 3.7% 3.8%

Expected option life (in years) .................................. 5.6 7.0

100