DIRECTV 2005 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

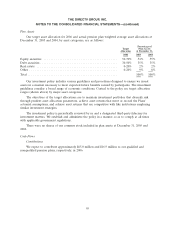

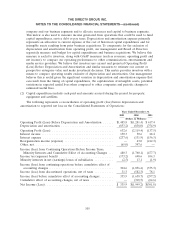

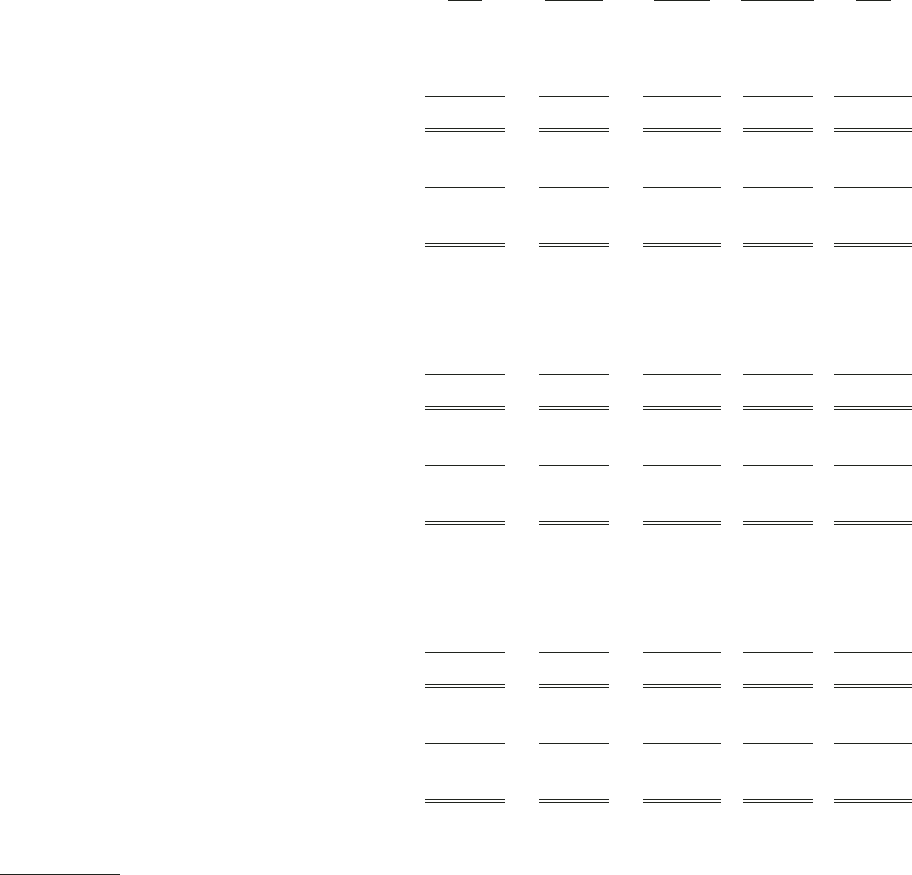

Selected information for our operating segments is reported as follows:

DIRECTV DIRECTV Latin Network Eliminations

U. S. America Systems and Other Total

(Dollars in Millions)

2005

External Revenues ..................... $12,211.3 $ 741.9 $ 211.4 $ (0.1) $13,164.5

Intersegment Revenues ................. 4.8 0.2 — (5.0) —

Revenues ........................... $12,216.1 $ 742.1 $ 211.4 $ (5.1) $13,164.5

Operating Profit (Loss) ................. $ 802.0 $ (18.7) $ (60.8) $ (89.9) $ 632.6

Add: Depreciation and amortization ........ 698.2 160.2 — (5.2) 853.2

Operating Profit (Loss) Before Depreciation

and Amortization(1) .................. $ 1,500.2 $ 141.5 $ (60.8) $ (95.1) $ 1,485.8

Segment Assets ....................... $10,525.0 $1,147.9 $ — $3,957.3 $15,630.2

Capital Expenditures(2) ................. 782.0 90.4 18.1 33.2 923.7

2004

External Revenues ..................... $ 9,738.1 $ 675.2 $ 946.7 $ — $11,360.0

Intersegment Revenues ................. 25.8 — 152.4 (178.2) —

Revenues ........................... $ 9,763.9 $ 675.2 $ 1,099.1 $ (178.2) $11,360.0

Operating Profit (Loss) ................. $ 21.9 $ (142.0) $(1,778.5) $ (220.8) $(2,119.4)

Add: Depreciation and amortization ........ 561.2 187.9 95.6 (6.7) 838.0

Operating Profit (Loss) Before Depreciation

and Amortization(1) .................. $ 583.1 $ 45.9 $(1,682.9) $ (227.5) $(1,281.4)

Segment Assets ....................... $ 8,994.2 $1,086.7 $ 521.1 $3,722.4 $14,324.4

Capital Expenditures(2) ................. 671.5 81.7 132.1 137.8 1,023.1

2003

External Revenues ..................... $ 7,654.1 $ 597.7 $ 1,105.2 $ 15.2 $ 9,372.2

Intersegment Revenues ................. 41.5 — 165.8 (207.3) —

Revenues ........................... $ 7,695.6 $ 597.7 $ 1,271.0 $ (192.1) $ 9,372.2

Operating Profit (Loss) ................. $ 458.8 $ (284.6) $ (103.4) $ (208.3) $ (137.5)

Add: Depreciation and amortization ........ 497.0 199.3 70.8 (12.2) 754.9

Operating Profit (Loss) Before Depreciation

and Amortization(1) .................. $ 955.8 $ (85.3) $ (32.6) $ (220.5) $ 617.4

Segment Assets ....................... $ 7,285.2 $ 682.9 $ 2,555.3 $8,514.0 $19,037.4

Capital Expenditures(2) ................. 389.0 57.9 159.6 140.9 747.4

(1) Operating Profit (Loss) Before Depreciation and Amortization, which is a financial measure that is

not determined in accordance with accounting principles generally accepted in the United States of

America, or GAAP, can be calculated by adding amounts under the caption ‘‘Depreciation and

amortization’’ to ‘‘Operating Profit (Loss).’’ This measure should be used in conjunction with

GAAP financial measures and is not presented as an alternative measure of operating results, as

determined in accordance with GAAP. Our management and Board of Directors use Operating

Profit (Loss) Before Depreciation and Amortization to evaluate the operating performance of our

104