DIRECTV 2005 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

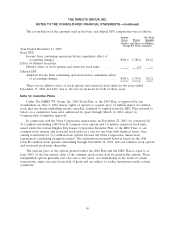

Note 18. DLA LLC Reorganization

On March 18, 2003, DLA LLC filed a voluntary petition for reorganization under Chapter 11 of

the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the District of Delaware, or Bankruptcy

Court. On February 13, 2004, the Bankruptcy Court confirmed DLA LLC’s Plan of Reorganization, or

the Reorganization Plan, which became effective on February 24, 2004.

Also, effective February 24, 2004, we made a contribution of certain claims, loans, equity and other

interests in LOCs selling the DIRECTV service in Latin America, and converted certain debt into

equity, which increased our equity interest in the restructured DLA LLC from 74.7% to approximately

86%. Darlene, which also contributed its equity and other interests in various LOCs, holds the

remaining approximately 14% equity interest in the restructured DLA LLC. The restructuring in

bankruptcy and the contributions by us and Darlene provided DLA LLC with direct control of the

most significant LOCs and assets. The net result of these transactions was an increase in minority

interests of $47.3 million.

Reorganization income was $43.0 million in 2004 compared to reorganization expense of

$212.3 million in 2003. The reorganization income in 2004 includes a $62.6 million gain that resulted

from the settlement of certain obligations in connection with the confirmation of the Reorganization

Plan, partially offset by costs incurred to file the bankruptcy petition, legal and consulting costs and

other charges related to the DLA LLC reorganization. Reorganization expense of $212.3 million in

2003 includes the costs incurred to file the bankruptcy petition, legal and consulting costs, costs of

settlement agreements reached with creditors, the write-off of intangible assets and other charges

related to the reorganization. Also included in reorganization expense are accruals for claims allowed in

the Chapter 11 proceeding.

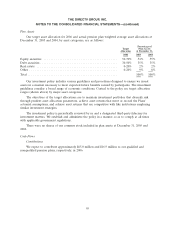

Note 19: Derivative Financial Instruments and Risk Management

Our cash flows and earnings are subject to fluctuations resulting from changes in foreign currency

exchange rates, interest rates and changes in the market value of our equity investments. We manage

our exposure to these market risks through internally established policies and procedures and, when

deemed appropriate, through the use of derivative financial instruments. We enter into derivative

instruments only to the extent considered necessary to meet our risk management objectives, and do

not enter into derivative contracts for speculative purposes. As of December 31, 2005 and 2004, we had

no significant foreign currency or interest related derivative financial instruments outstanding.

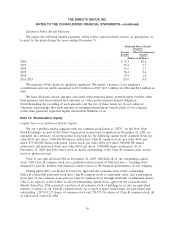

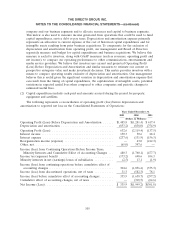

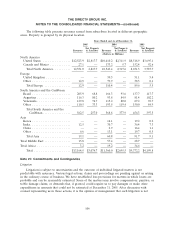

Note 20: Segment Reporting

Our two continuing business segments, DIRECTV U.S. and DIRECTV Latin America, which are

differentiated by their geographic location, are engaged in acquiring, promoting, selling and/or

distributing digital entertainment programming via satellite to residential and commercial subscribers.

Through April 22, 2005, we also operated the Network Systems segment, a provider of satellite-based

private business networks and broadband Internet access. As a result of the SkyTerra transactions

described in Note 3, after April 22, 2005, we no longer consolidate HNS, which formerly comprised the

Network Systems segment. Eliminations and other includes the corporate office and other entities.

103