DIRECTV 2005 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

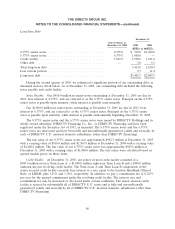

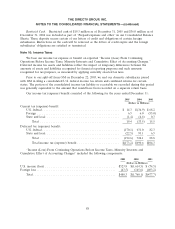

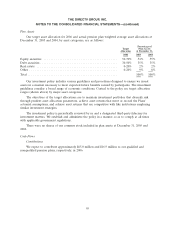

Our notes payable and credit facility mature as follows: $9.4 million in 2006; $10.1 million in 2007;

$47.6 million in 2008; $97.6 million in 2009, $297.5 million in 2010 and $2,949.7 million thereafter.

These amounts do not reflect potential prepayments that may be required under our senior secured

credit facility, which could result from a computation of excess cash flows that we may be required to

make at each year end under the credit agreement. We were not required to make a prepayment for

the years ended December 31, 2005 and 2004. However, we made a prepayment of $201.0 million on

April 15, 2004 for the year ended December 31, 2003. The amount of interest accrued related to our

outstanding debt was $28.4 million at December 31, 2005 and $36.5 million at December 31, 2004. The

unamortized bond premium included in other debt as of December 31, 2005 was $3.1 million.

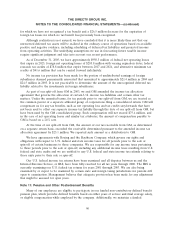

Covenants and Restrictions. The senior secured credit facility requires DIRECTV U.S. to comply

with certain financial covenants. The senior notes and the senior secured credit facility also include

covenants that restrict DIRECTV U.S.’ ability to, among other things, (i) incur additional indebtedness,

(ii) incur liens, (iii) pay dividends or make certain other restricted payments, investments or

acquisitions, (iv) enter into certain transactions with affiliates, (v) merge or consolidate with another

person, (vi) sell, assign, lease or otherwise dispose of all or substantially all of our assets, and

(vii) make voluntary prepayments of certain debt, in each case subject to exceptions as provided in the

credit agreement and senior notes indentures. Should we fail to comply with these covenants, all or a

portion of our borrowings under the senior notes and senior secured credit facility could become

immediately payable and the revolving credit facility could be terminated. At December 31, 2005,

DIRECTV U.S. was in compliance with all such covenants.

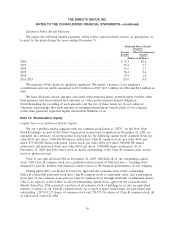

2005 Refinancing Transactions. In April 2005, we replaced our prior credit facility with the senior

secured credit facility described above. The senior secured credit facility was initially comprised of a

$500.0 million six-year Term Loan A, a $1,500.0 million eight-year Term Loan B, both of which were

fully funded, and a $500.0 million undrawn six-year revolving credit facility. We used a portion of the

$2,000.0 million proceeds from the transaction to repay our prior credit facility that had a then

outstanding balance of $1,001.6 million and to pay related financing costs and accrued interest.

Borrowings under the prior credit facility bore interest at a rate equal to LIBOR plus 1.75%.

On May 19, 2005, we redeemed $490.0 million of our then outstanding $1,400.0 million 8.375%

senior notes at a redemption price of 108.375% plus accrued and unpaid interest, for a total of

$538.3 million.

On June 15, 2005, the Co-Issuers issued $1,000.0 million of 6.375% senior notes. We used a

portion of the proceeds from the transaction to repay $500.0 million of the Term Loan B portion of

our senior secured credit facility and to pay related financing costs.

The repayment of our prior senior secured credit facility, the partial repayment of our senior

secured credit facility and the partial redemption of our 8.375% senior notes resulted in a 2005 pre-tax

charge of $64.9 million ($40.0 million after tax) of which $41.0 million was associated with the premium

paid for the redemption of our 8.375% senior notes and $23.9 million with the write-off of a portion of

our deferred debt issuance costs and other transaction costs. The charge was recorded in ‘‘Other, net’’

in the Consolidated Statements of Operations.

Prior Debt Transactions. During 2003, we raised approximately $2,625.0 million of cash through

the issuance of $1,400.0 million of 8.375% senior notes and $1,225.0 million of borrowings under a

credit facility. We used a portion of these proceeds to repay the $506.3 million outstanding principal

balance plus accrued interest under a prior credit facility agreement, which then terminated.

87