DIRECTV 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

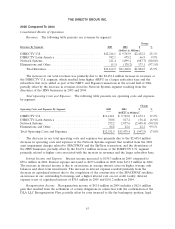

The increase in our total operating costs and expenses in 2004 was primarily due to the

$2,505.2 million increase at the DIRECTV U.S. segment primarily related to higher costs associated

with the larger subscriber base and the $1,656.7 million in asset impairment charges related to

SPACEWAY and the SkyTerra transactions at the Network Systems segment.

Interest Income and Expense. Interest income increased to $50.6 million in 2004 compared to

$28.4 million in 2003. Interest expense decreased to $131.9 million in 2004 from $156.3 million in 2003.

The increase in interest income is due to an increase in average cash balances and the $11.2 million in

interest income received as part of the judgment against Pegasus. The decrease in interest expense

resulted primarily from lower interest on DIRECTV U.S.’ credit facilities resulting from a reduced

interest rate and lower outstanding borrowings. Interest expense is net of capitalized interest of

$101.2 million in 2004 and $120.0 million in 2003.

Reorganization Expense. Reorganization income was $43.0 million in 2004 compared to

reorganization expense of $212.3 million in 2003. The reorganization income in 2004 includes a

$62.6 million gain as a result of the settlement of certain obligations in connection with the

confirmation of the DLA LLC Reorganization Plan, partially offset by costs incurred to file the

bankruptcy petition, legal and consulting costs and other charges related to such reorganization.

Reorganization expense of $212.3 million in 2003 includes the costs incurred to file the bankruptcy

petition, ongoing related legal and consulting costs, costs related to settlement agreements reached with

creditors, the write-off of intangible assets and other charges related to the reorganization. Also

included in reorganization expense are accruals for any claims allowed in the Chapter 11 proceeding.

See Note 18 of the Notes to the Consolidated Financial Statements in Part II, Item 8 for further

information.

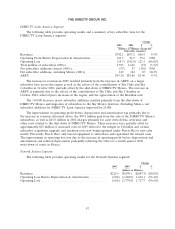

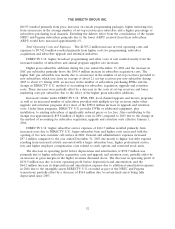

Other, Net. Other, net increased by $397.6 million during 2004. The significant components of

‘‘Other, net’’ were as follows:

2004 2003 Change

(Dollars in Millions)

Net gain from sale of investments ................................ $396.5 $ 7.5 $389.0

Equity losses from unconsolidated affiliates ......................... (0.2) (81.5) 81.3

Net unrealized gain on investments ............................... — 79.4 (79.4)

Other .................................................... 1.3 (5.4) 6.7

Total ..................................................... $397.6 $ — $397.6

During 2004, we sold various equity investments for $510.5 million in cash, which resulted in us

recording a pre-tax gain of $396.5 million.

For 2003, equity losses from unconsolidated affiliates is primarily comprised of losses at the

DTVLA LOCs.

Net unrealized gain on investments for 2003 includes a $79.6 million gain resulting from an

increase in the fair value of an investment in a convertible note.

Income Tax Benefit. We recognized an income tax benefit of $690.6 million in 2004 compared to

an income tax benefit of $104.3 million in 2003. The higher income tax benefit for 2004 was primarily

due to higher pre-tax losses in the current year, utilization of prior year foreign tax losses for which no

tax benefit had previously been recognized and a decrease in foreign withholding taxes.

49