DIRECTV 2005 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

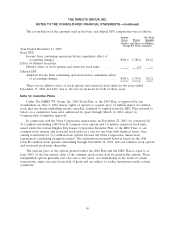

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

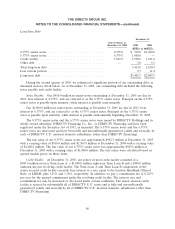

for which we have not recognized a tax benefit and a $26.5 million decrease for the expiration of

foreign tax losses for which no tax benefit has previously been recognized.

Although realization is not assured, we have concluded that it is more likely than not that our

unreserved deferred tax assets will be realized in the ordinary course of operations based on available

positive and negative evidence, including scheduling of deferred tax liabilities and projected income

from operating activities. The underlying assumptions we use in forecasting future taxable income

require significant judgment and take into account our recent performance.

As of December 31, 2005, we have approximately $950.3 million of federal net operating losses

that expire in 2023, foreign net operating losses of $285.8 million with varying expiration dates, federal

research tax credits of $78.8 million that expire between 2017 and 2024, and alternative minimum tax

credits of $41.6 million that can be carried forward indefinitely.

No income tax provision has been made for the portion of undistributed earnings of foreign

subsidiaries deemed permanently reinvested that amounted to approximately $21.4 million in 2004 and

$24.5 million in 2003. It is not practicable to determine the amount of the unrecognized deferred tax

liability related to the investments in foreign subsidiaries.

As part of our split-off from GM in 2003, we and GM amended the income tax allocation

agreement that governs the allocation of certain U.S. income tax liabilities and certain other tax

matters. Under the amended terms, for tax periods prior to our split-off from GM, we are treated as

the common parent of a separate affiliated group of corporations filing a consolidated return. GM will

compensate us for any tax benefits, such as net operating loss and tax credit carryforwards that have

not been used to offset our separate income tax liability through the date of our split-off from GM, but

have been used by the GM consolidated group. Such compensation will not exceed $75.4 million, and

in the case of net operating losses and similar tax attributes, the amount of compensation payable to

GM is based on a 24% rate.

At the time of our split-off from GM, the amount of our tax receivable from GM, as determined

on a separate return basis, exceeded the receivable determined pursuant to the amended income tax

allocation agreement by $25.1 million. We reported such amount as a distribution to GM.

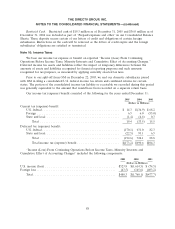

We have agreements with Boeing and the Raytheon Company, which govern our rights and

obligations with respect to U.S. federal and state income taxes for all periods prior to the sale or

spin-off of certain businesses to those companies. We are responsible for any income taxes pertaining

to those periods prior to the sale or spin-off, including any additional income taxes resulting from U.S.

federal and state audits and we are entitled to any U.S. federal and state income tax refunds relating to

those units prior to their sale or spin-off.

Our U.S. federal income tax returns have been examined and all disputes between us and the

Internal Revenue Service, or IRS, have been fully resolved for all tax years through 2000. The IRS is

currently examining our U.S. federal tax returns for years 2001 through 2003. We are also being

examined by or expect to be examined by certain state and foreign taxing jurisdictions for periods still

open to examination. Management believes that adequate provision has been made for any adjustment

that might be assessed for open years.

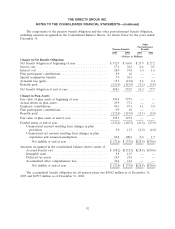

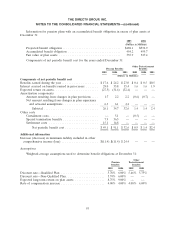

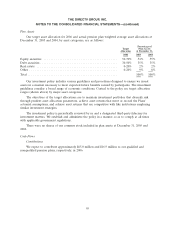

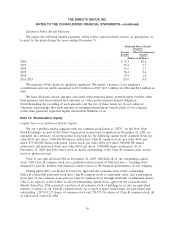

Note 11: Pension and Other Postretirement Benefits

Many of our employees are eligible to participate in our funded non-contributory defined benefit

pension plan, which provides defined benefits based on either years of service and final average salary,

or eligible compensation while employed by the company. Additionally, we maintain a funded

90