DIRECTV 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

change significantly due to the lease model, as the monthly mirroring fees currently charged to

subscribers will generally be replaced with monthly lease fees; however, a portion of the upfront fees

charged to subscribers will be deferred and recognized over the estimated subscriber life. The following

discussion of expected results in 2006 is presented on a comparable basis to historical results, and

accordingly does not reflect the anticipated changes in reported operating costs and expenses resulting

from the lease program.

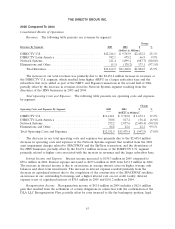

Revenues. Our revenue increases over the last three years have been driven by the growing

subscriber base, including the 1.4 million NRTC and Pegasus subscribers acquired in the second and

third quarters of 2004, and increasing ARPU at DIRECTV U.S. After accounting for churn,

DIRECTV U.S.’ net new subscriber additions were 1.2 million during 2005 and 1.8 million in 2004

(excluding the NRTC and Pegasus subscribers). Net new DIRECTV U.S. subscriber additions are

expected to exceed 1.0 million in 2006. DIRECTV U.S. expects churn to improve in 2006 as compared

to average monthly subscriber churn of 1.70% for 2005. The improvement in churn is expected to result

from our continuing efforts to limit the number of high risk subscribers added to our platform, an

increase in the number of subscribers with advanced products, such as HD and DVR set-top receivers,

the development of unique and differentiated content, and initiatives to further improve subscriber

service. DIRECTV U.S.’ ARPU increased 4.0% in 2005 and 4.7% in 2004. DIRECTV U.S. expects the

percentage increase in ARPU for 2006 to be slightly higher than the 2005 increase due mostly to its

planned programming package price increases in March 2006, an increase in mirroring/lease fees from

subscribers with multiple set-top receivers and higher sports programming revenues.

Operating Costs and Expenses. Operating costs and expenses as a percentage of revenues

decreased from approximately 100% in 2004 to 93% in 2005 due to the stabilization of costs in key

areas such as subscriber acquisition, upgrade and retention costs. DIRECTV U.S. expects operating

costs and expenses as a percentage of revenue to continue to improve in 2006 due to the expected

higher revenues discussed above and stable subscriber acquisition costs, partially offset by higher

programming costs, upgrade and retention costs and depreciation and amortization expense. Upgrade

and retention costs are expected to increase due to increased demand for HD set-top receivers driven

by our roll-out of additional local-into-local HD markets as well as upgrading our current HD

subscribers to MPEG-4 capable set-top receivers and increased demand for DVRs. The anticipated

increase in depreciation expense will result primarily from our three new satellites launched during

2005.

Cash Flows. We expect consolidated cash flow, defined as net cash provided by operating

activities less net cash used in investing activities, to increase slightly in 2006 compared to 2005

resulting from an expected improvement in operating costs as a percentage of revenues, partially offset

by an increase in cash required for sports programming contract payments, approximately $204 million

in net cash requirements for the Sky Transactions and slightly higher capital expenditures for satellites

and broadcast equipment to support our launch of new local and HD channels, and to replace and

backup existing satellites.

42