DIRECTV 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

DIRECTV U.S. Segment

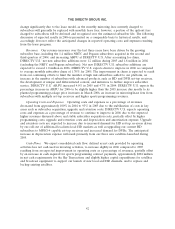

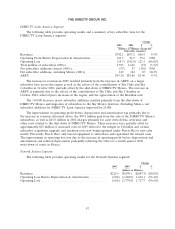

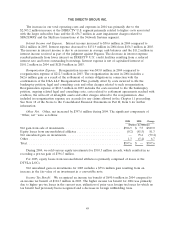

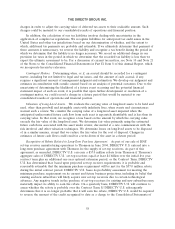

The following table provides operating results and a summary of key subscriber data for the

DIRECTV U.S. segment:

Change

2004 2003 $ %

(Dollars in Millions, Except Per Subscriber

Amounts)

Revenues ....................................... $9,763.9 $7,695.6 $2,068.3 26.9%

Operating Costs and Expenses, exclusive of depreciation and

amortization expense shown separately below:

Broadcast programming and other costs of sale ........ 4,010.5 3,229.8 780.7 24.2%

Subscriber service expenses ....................... 740.2 623.5 116.7 18.7%

Subscriber acquisition costs:

Third party customer acquisitions ............... 1,960.8 1,388.4 572.4 41.2%

Direct customer acquisitions ................... 684.1 395.1 289.0 73.1%

Upgrade and retention costs ...................... 993.2 404.4 588.8 145.6%

Broadcast operations expenses .................... 129.7 133.4 (3.7) (2.8)%

General and administrative expenses ................ 662.3 565.2 97.1 17.2%

Depreciation and amortization expense ................. 561.2 497.0 64.2 12.9%

Total Operating Costs and Expenses ............. 9,742.0 7,236.8 2,505.2 34.6%

Operating Profit .................................. $ 21.9 $ 458.8 $ (436.9) (95.2)%

Other Data:

Operating Profit Before Depreciation & Amortization ...... $ 583.1 $ 955.8 $ (372.7) (39.0)%

Total number of subscribers (000’s) .................... 13,940 12,212 1,728 14.2%

ARPU ......................................... $ 66.95 $ 63.92 $ 3.03 4.7%

Average monthly subscriber churn% ................... 1.59% 1.55% — 2.6%

Average subscriber acquisition costs — per subscriber (SAC) . . $ 643 $ 593 $ 50 8.4%

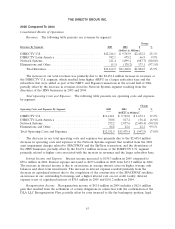

Subscribers. DIRECTV U.S. had approximately 13.9 million subscribers at December 31, 2004,

which included approximately 1.4 million subscribers in the former NRTC and Pegasus territories that

DIRECTV U.S. purchased in the second half of 2004. At December 31, 2003, DIRECTV U.S. had

approximately 12.2 million subscribers, which included 10.7 million owned and operated subscribers and

1.5 million subscribers in the former NRTC and Pegasus territories. In 2004, excluding the subscribers

from the former NRTC and Pegasus territories, DIRECTV U.S. added 4.0 million gross new owned

and operated subscribers, an increase of 34% over the prior year, due to a higher number of

subscribers acquired in local channel markets, more attractive consumer promotions, and an improved

and more diverse distribution network. After accounting for churn, DIRECTV U.S. added 1.8 million

net new owned and operated subscribers, or 1.7 million total subscribers including the former NRTC

members and affiliates and Pegasus during 2004.

DIRECTV U.S.’ average monthly subscriber churn increased to 1.59% for the year ended

December 31, 2004 compared to average monthly subscriber churn of 1.55% for the year ended

December 31, 2003 primarily due to a more competitive marketplace and higher involuntary churn

mostly related to the substantial increase in gross subscriber acquisitions over the past year.

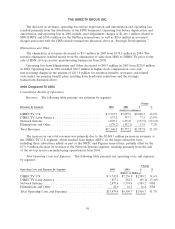

Revenues. The $2,068.3 million increase in revenues to $9,763.9 million resulted from DIRECTV

U.S.’ new subscribers added in 2004, including those subscribers added as part of the NRTC and

Pegasus transactions, and higher ARPU on the larger subscriber base. The 4.7% increase in ARPU to

51