DIRECTV 2005 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE DIRECTV GROUP, INC.

$66.95 resulted primarily from price increases on certain programming packages, higher mirroring fees

from an increase in the average number of set-top receivers per subscriber and a higher percentage of

subscribers purchasing local channels. Excluding the dilutive effect from the consolidation of the former

NRTC and Pegasus subscribers primarily due to the lower ARPU received from these subscribers,

ARPU would have increased approximately 6%.

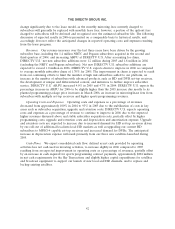

Total Operating Costs and Expenses. The $2,505.2 million increase in total operating costs and

expenses to $9,742.0 million resulted primarily from higher costs for programming, subscriber

acquisitions and subscriber upgrade and retention initiatives.

DIRECTV U.S.’ higher broadcast programming and other costs of sale resulted mostly from the

increased number of subscribers and annual program supplier rate increases.

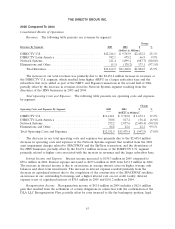

Higher gross subscriber additions during the year ended December 31, 2004 and the increase in

SAC per subscriber primarily drove the $861.4 million increase in subscriber acquisition costs. The

higher SAC per subscriber was mostly due to an increase in the number of set-top receivers provided to

new subscribers, which rose from an average of about 2.1 set-top receivers per new subscriber during

2003 to about 2.5 during 2004, an increase in the number of subscribers purchasing DVRs and the

change in DIRECTV U.S.’ method of accounting for subscriber acquisition, upgrade and retention

costs. These increases were partially offset by a decrease in the costs of set-top receivers and lower

marketing costs per subscriber due to the effect of the higher gross subscriber additions.

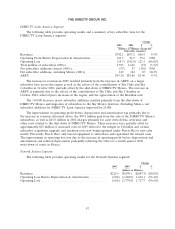

Increased volume under DIRECTV U.S.’ DVR, HD, local channel upgrade and movers programs

as well as an increased number of subscribers provided with multiple set-top receivers under other

upgrade and retention programs drove most of the $588.8 million increase in upgrade and retention

costs. Under these programs, DIRECTV U.S. provides DVRs or additional equipment, plus

installation, to existing subscribers at significantly reduced prices or for free. Also contributing to the

change was approximately $59.8 million of higher costs in 2004 compared to 2003 due to the change in

the method of accounting for subscriber acquisition, upgrade and retention costs effective January 1,

2004.

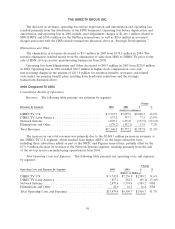

DIRECTV U.S.’ higher subscriber service expenses of $116.7 million resulted primarily from

increased costs due to DIRECTV U.S.’ larger subscriber base and higher costs associated with the

opening of two new customer call centers in 2004. General and administrative expenses increased

$97.1 million compared to the year ended December 31, 2003 due mostly to higher bad debt expense

resulting from increased activity associated with a larger subscriber base, higher professional service

fees and higher employee compensation costs related to stock options and restricted stock units.

The decrease in operating profit before depreciation and amortization of $372.7 million was

primarily due to higher subscriber acquisition costs and upgrade and retention costs, partially offset by

an increase in gross margin on the higher revenues discussed above. The decrease in operating profit of

$436.9 million was due to lower operating profit before depreciation and amortization, and the

$64.2 million increase in depreciation and amortization expense due to additional amortization expense

in 2004 due to the intangible assets DIRECTV U.S. recorded as part of the NRTC and Pegasus

transactions, partially offset by a decrease of $56.4 million due to certain fixed assets being fully

depreciated since 2003.

52