DIRECTV 2005 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

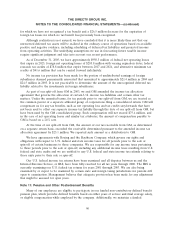

Other Discontinued Operations

During 2003, we recorded a gain of $1.6 million to ‘‘Income (loss) from discontinued operations,

net of taxes’’ in the Consolidated Statements of Operations as a result of final adjustments to accruals

recorded for the shut-down of DIRECTV Broadband. During 2003, we made net payments of

$69.5 million to settle obligations of DIRECTV Broadband, which are included in ‘‘Cash Flows from

Discontinued Operations’’ in the Consolidated Statements of Cash Flows. These payments primarily

represent cash used in operating activities.

Pursuant to a settlement agreement executed on July 15, 2003 related to the purchase price

adjustment dispute arising from the 2000 sale of our satellite systems manufacturing businesses to The

Boeing Company, or Boeing, we recorded an after-tax charge of $6.3 million to ‘‘Income (loss) from

discontinued operations, net of taxes’’ in the Consolidated Statements of Operations during 2003. On

July 18, 2003, we paid the $360.0 million settlement amount to Boeing, which is included in ‘‘Cash

Flows from Discontinued Operations’’ in the Consolidated Statements of Cash Flows. This payment

represents cash used in investing activities.

As discussed in more detail in Note 21, during 2005, we recorded a $31.3 million gain in ‘‘Income

(loss) from discontinued operations, net of taxes’’ in our Consolidated Statements of Operations that

resulted from a favorable tax settlement related to a previously discontinued operation.

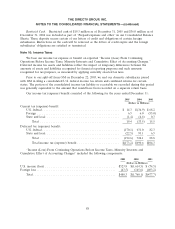

‘‘Income (loss) from discontinued operations, net of taxes,’’ as reported in the Consolidated

Statements of Operations, is comprised of the following:

Years Ended December 31,

2005 2004 2003

(Dollars in Millions, Except

Per Share Amounts)

Income from discontinued operations, net of taxes .............. $ — $ 50.8 $82.8

Gain (loss) on sale of discontinued operations, net of taxes ....... 31.3 (633.1) (4.7)

Income (loss) from discontinued operations, net of taxes ........ $31.3 $(582.3) $78.1

Basic and Diluted Earnings (Loss) Per Common Share:

Income from discontinued operations, net of taxes .............. $ — $ 0.04 $0.06

Gain (loss) on sale of discontinued operations, net of taxes ....... 0.02 (0.46) —

Income (loss) from discontinued operations, net of taxes ...... $0.02 $ (0.42) $0.06

81