DIRECTV 2005 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2005 DIRECTV annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE DIRECTV GROUP, INC.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS —(continued)

Immediately prior to the News Corporation transactions, we adjusted the number of shares of

common and Class B common stock to assure that the stock outstanding and the stock representing

GM’s interest accurately reflected the interests to be sold directly by GM to News Corporation and the

interests to be distributed to holders of GM Class H common stock. After the adjustment, there were

1,109,270,842 shares of our common stock then outstanding. We adjusted the number of shares of

Class B common stock to equal 274,319,607 shares, representing GM’s 19.8% interest in us.

On December 22, 2003, GM split us off by distributing our common stock to the holders of GM

Class H common stock in exchange for the 1,109,270,842 GM Class H common shares then outstanding

on a one-for-one basis. Simultaneously, GM sold its 19.8% interest in us (represented by 274,319,607

shares of Class B common stock) to News Corporation in exchange for cash and News Corporation

Preferred ADSs. We then converted the shares of Class B common stock to shares of our common

stock on a one-for-one basis.

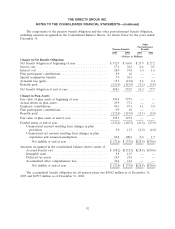

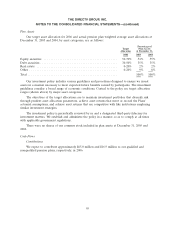

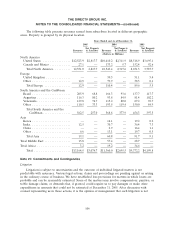

Accumulated Other Comprehensive Loss

As of December 31,

2005 2004

(Dollars in Millions)

Minimum pension liability adjustment ................................ $(34.4) $(41.4)

Accumulated unrealized gains on securities ............................ 23.1 22.0

Accumulated foreign currency translation adjustments .................... (2.7) (5.3)

Total Accumulated Other Comprehensive Loss ...................... $(14.0) $(24.7)

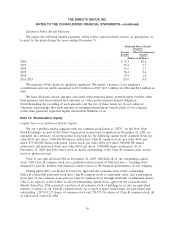

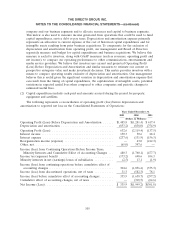

Other Comprehensive Income

The following represents changes in the components of OCI, net of taxes, as of December 31:

2005 2004 2003

Tax Tax

Pre-tax Tax Net Pre-tax (Benefit) Net Pre-tax (Benefit) Net

Amount Expense Amount Amount Expense Amount Amount Expense Amount

(Dollars in Millions)

Minimum pension liability

adjustments ............. $11.4 $4.4 $7.0 $ 11.4 $ 4.0 $ 7.4 $(24.4) $ (7.9) $ (16.5)

Foreign currency translation

adjustments:

Unrealized gains ........... 2.6 — 2.6 14.8 — 14.8 6.0 — 6.0

Unrealized holding gains

(losses) on securities:

Unrealized holding gains

(losses) ................ 1.1 0.4 0.7 (9.1) (3.5) (5.6) 446.8 171.5 275.3

Less: reclassification

adjustment for net losses

(gains) recognized during the

period ................. 0.6 0.2 0.4 (243.8) — (243.8) (0.6) — (0.6)

97