Classmates.com 2007 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

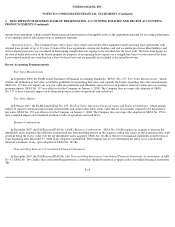

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

In November 2005, the Financial Accounting Standards Board ("FASB") issued FASB Staff Position ("FSP") No. SFAS 123(R)-3,

Transition Election Related to Accounting for Tax Effects of Share-Based Payment Awards . The alternative transition method includes

simplified methods to establish the beginning balance of the additional paid-in capital pool ("APIC pool") related to the tax effects of employee

share-

based compensation, and to determine the subsequent impact on the APIC pool and consolidated statements of cash flows of the tax effects

of employee share-based payment awards that were outstanding upon adoption of SFAS No. 123R. In the June 2006 quarter, the Company

adopted the provisions of FSP No. SFAS 123(R)-3.

As a result of the adoption SFAS No. 123R, the Company's income before income taxes and net income for the year ended December 31,

2006 were $7.0 million and $5.1 million lower, respectively, than if the Company had continued to account for stock-based compensation under

APB Opinion No. 25. Basic net income per share and diluted net income per share for the year ended December 31, 2006 were $0.08 and $0.08

lower, respectively, than if the Company had continued to account for stock-based compensation under APB Opinion No. 25.

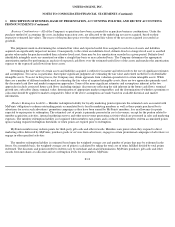

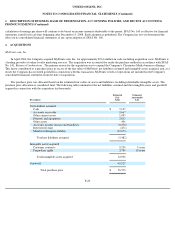

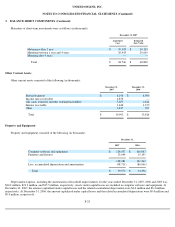

The following table illustrates (in thousands, except per share amounts) the effect on net income and earnings per share in the year ended

December 31, 2005 as if the Company had applied the fair value recognition provisions of SFAS No. 123, as amended by SFAS No. 148,

Accounting for Stock

-Based Compensation—Transition and Disclosure .

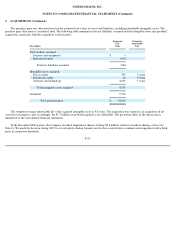

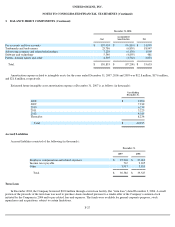

Comprehensive Income— SFAS No. 130, Reporting Comprehensive Income, establishes standards for reporting comprehensive income

and its components in financial statements. Comprehensive income, as defined, includes all changes in equity (net assets) during a period from

non-owner sources. For the Company, comprehensive income consists of its reported net income, changes in net unrealized gains or losses on

short-term investments and derivatives, and foreign currency translation.

Foreign Currency— The functional currency of the Company's international subsidiaries is the local currency. The financial statements of

these subsidiaries are translated to U.S. dollars using period-

end rates of exchange for assets and liabilities, and average rates of exchange for the

period for revenues and expenses. Translation gains and losses are recorded in accumulated other comprehensive income

F-17

Year Ended

December 31,

2005

Net income, as reported

$

47,127

Add: Stock

-

based compensation included in net income, net of tax

8,264

Deduct: Stock-based compensation determined under fair value-based

method for all equity awards, net of tax

(23,360

)

Pro forma net income

$

32,031

Basic net income per share, as reported

$

0.77

Basic net income per share, pro forma

$

0.52

Diluted net income per share, as reported

$

0.74

Diluted net income per share, pro forma

$

0.50