Classmates.com 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In December 2007, we determined that proceeding with the IPO under then-current market conditions was not in the best interests of our

stockholders and we withdrew CMC's Form S-1 registration statement previously filed with the SEC. Approximately $0.5 million of transaction

costs were determined not to have continuing value after the withdrawal of the IPO and were expensed in the quarter ended December 31, 2007.

It remains our strategy to complete an IPO of CMC. As such, certain additional IPO transaction-related costs totaling $3.6 million associated

with the IPO have been deferred and are included in other assets on our consolidated balance sheet at December 31, 2007. If we do not proceed

with this strategy, these deferred costs will be expensed and included in the Classmates Media segment operating results as well as in our

consolidated statements of operations in a future period.

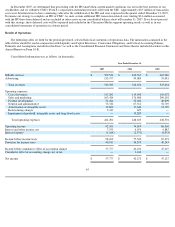

Results of Operations

The following tables set forth for the periods presented, selected historical statements of operations data. The information contained in the

tables below should be read in conjunction with Liquidity and Capital Resources, Contractual Obligations, and Critical Accounting Policies,

Estimates and Assumptions included in this Item 7 as well as the Consolidated Financial Statements and Notes thereto included elsewhere in this

Annual Report on Form 10-K.

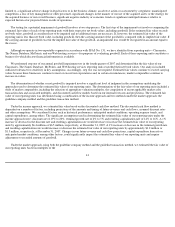

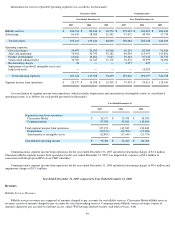

Consolidated information was as follows (in thousands):

45

Year Ended December 31,

2007

2006

2005

Billable services

$

379,526

$

423,565

$

465,980

Advertising

133,977

99,089

59,081

Total revenues

513,503

522,654

525,061

Operating expenses:

Cost of revenues

117,203

119,990

110,672

Sales and marketing

163,424

176,980

209,292

Product development

51,044

52,602

40,009

General and administrative

73,312

67,511

56,729

Amortization of intangible assets

12,800

17,640

21,799

Restructuring charges

3,419

627

—

Impairment of goodwill, intangible assets and long

-

lived assets

—

13,285

—

Total operating expenses

421,202

448,635

438,501

Operating income

92,301

74,019

86,560

Interest and other income, net

7,555

6,076

6,885

Interest expense

(1,164

)

(2,571

)

(6,073

)

Income before income taxes

98,692

77,524

87,372

Provision for income taxes

40,915

36,293

40,245

Income before cumulative effect of accounting change

57,777

41,231

47,127

Cumulative effect of accounting change, net of tax

—

1,041

—

Net income

$

57,777

$

42,272

$

47,127