Classmates.com 2007 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. ACQUISITIONS (Continued)

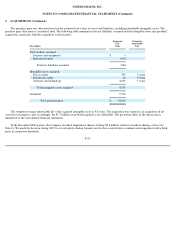

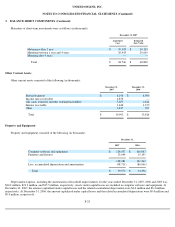

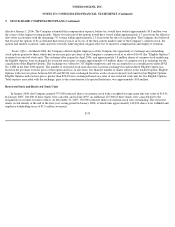

The purchase price was allocated based on the estimated fair values of assets and liabilities, including identifiable intangible assets. The

purchase price allocation is considered final. The following table summarizes the net liabilities assumed and the intangible assets and goodwill

acquired in connection with the acquisition (in thousands):

The weighted-average amortizable life of the acquired intangible assets is 4.8 years. The acquisition was treated as an acquisition of net

assets for tax purposes and, accordingly, the $5.7 million of goodwill acquired is tax deductible. The pro forma effect of the transaction is

immaterial to the consolidated financial statements.

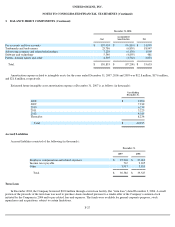

In the December 2006 quarter, the Company recorded impairment charges totaling $8.8 million related to its photo sharing service (see

Note 6). We made the decision during 2007 to exit our photo sharing business and we have entered into a commercial arrangement with a third

-

party in connection therewith.

F-23

Description

Estimated

Fair

Value

Estimated

Amortizable

Life

Net liabilities assumed:

Property and equipment

$

4

Deferred revenue

(190

)

Total net liabilities assumed

(186

)

Intangible assets acquired:

Pay accounts

330

2 years

Proprietary rights

20

5 years

Software and technology

4,200

5 years

Total intangible assets acquired

4,550

Goodwill

5,738

Total purchase price

$

10,102