Classmates.com 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

Reclassifications— Certain prior year amounts have been reclassified to conform to the current year presentation. These changes had no

impact on the previously reported consolidated results of operations or stockholders' equity.

Accounting Policies

Cash, Cash Equivalents and Short-Term Investments— The Company considers cash equivalents to be only those investments which are

highly liquid, readily convertible to cash and which have a maturity date within ninety days from the date of purchase. The Company's short-

term investments consist of available-for-sale securities with maturities exceeding ninety days from the date of purchase. Consistent with

Statement of Financial Accounting Standards ("SFAS") No. 115, Accounting for Certain Investments in Debt and Equity Securities, the

Company has classified these securities, all of which have readily determinable fair values and which are highly liquid, as short-

term because the

sale of such securities may be required prior to maturity to implement management's strategies.

The Company's short-term investments at December 31, 2007 consisted of municipal securities, and at December 31, 2006, U.S. corporate

notes, U.S. Government agencies, and municipal securities, including auction rate securities. Auction rate securities have long-term underlying

maturities, typically 20 to 30 years, but have interest rates that are reset every 7, 28 or 35 days, at which time the securities can typically be

purchased or sold, historically creating a highly liquid market. As a result of the recent adverse conditions in the U.S. credit markets, the

Company liquidated, without any losses in principal, its investments in auction rate securities and did not hold any auction rate securities as of

December 31, 2007. The primary objective of the Company's short-

term investments portfolio is the preservation of principal and liquidity while

maximizing yield without significantly increasing risk. The Company's investment policy requires a minimum long-term credit rating of A, and

if a long-term credit rating is not available, the Company requires a minimum short-term credit rating of A1 and P1. Furthermore, by policy, the

Company limits the amount of credit exposure to any one issuer. The Company's investments, at times in both fixed-rate and variable-rate

interest-earning instruments, carry a degree of interest rate risk. Fixed-rate securities may have their fair market value adversely impacted due to

a rise in interest rates, while variable-rate securities may produce less income than expected if interest rates fall. Due in part to these factors, the

Company's future investment income may fall short of expectations due to changes in interest rates, or it may suffer losses in principal by selling

securities which have declined in market value due to changes in interest rates.

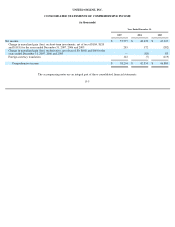

The Company classifies all of its short-term investments as available-for-sale. Available-for-sale securities are carried at fair value, with

changes in unrealized gains and losses, net of taxes, reported in the consolidated statements of comprehensive income. Realized gains or losses

and permanent declines in value, if any, on available-for-sale securities are reported in interest and other income, net, in the consolidated

statements of operations. The cost basis of a security that has been sold and any amount reclassified out of accumulated other comprehensive

income (loss) in the consolidated balance sheets into earnings is determined by the specific identification method.

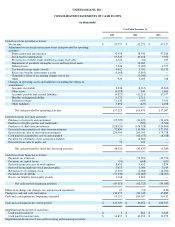

The Company classifies outstanding interest payments due on its short-term investments as interest receivable, the balance of which is

reflected in other current assets in the consolidated balance sheets.

The Company regularly assesses whether an other-than-temporary impairment loss on its short-term investments has occurred due to

declines in fair value or other market conditions. Declines in fair value that are considered other than temporary are recorded as an impairment

charge and reported in the consolidated statements of operations. Factors considered by management in assessing

F-9