Classmates.com 2007 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

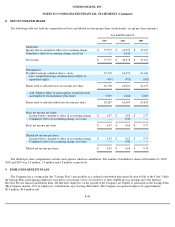

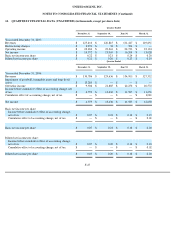

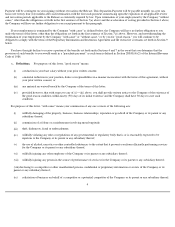

UNITED ONLINE, INC.

SCHEDULE II—VALUATION AND QUALIFYING ACCOUNTS

(in thousands)

(a)

Balance at

Beginning

of Period

Additions

Charged

(Credited) to

Expense

Charged

to Other

Accounts

Charges

Utilized

(Write-offs)

Balance at

End

of Period

Allowance for doubtful accounts:

Year ended December 31, 2007 $

1,324

$

1,323

$

206

$

(475

)

(b)

$

2,378

Year ended December 31, 2006

$

1,325

$

(298

)

$

300

(a)

$

(3

)

(b)

$

1,324

Year ended December 31, 2005

$

647

$

678

$

—

$

—

$

1,325

Valuation allowance for deferred tax assets:

Year ended December 31, 2007

$

6,850

$

2,546

(e)

$

—

$

(

773

)

(d)

$

8,623

Year ended December 31, 2006

$

4,670

$

3,464

(c)

$

—

$

(

1,284

)

(d)

$

6,850

Year ended December 31, 2005

$

1,938

$

2,732

(c)

$

—

$

—

$

4,670

Represents allowance for doubtful accounts acquired in connection with the acquisition of MyPoints.

(b) Represents specific amounts written off that were considered to be uncollectible.

(c) Represents the increase in valuation allowance primarily due to executive compensation that is limited under Section 162(m) of the Code

and foreign losses, the benefit of which is not currently recognizable due to uncertainty regarding realization.

(d) Represents the release of valuation allowance for executive compensation subject to Section 162(m) of the Code.

(e) Represents the increase in valuation allowance due to executive compensation that is limited under Section 162(m) of the Code and

foreign losses, the benefit of which is not currently recognizable due to uncertainty regarding realization, partially offset by a $0.4 million

reduction for the release of valuation allowance related to net operating losses in connection with the acquisition of Classmates.

F-48