Classmates.com 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

(loss) as a component of stockholders' equity in the consolidated balance sheets. Net gains and losses resulting from foreign exchange

transactions were not significant during the periods presented.

Income Taxes— Income taxes are accounted for under SFAS No. 109, Accounting for Income Taxes . Under SFAS No. 109, deferred tax

assets and liabilities are determined based on differences between the financial reporting and tax basis of assets and liabilities and are measured

using the enacted tax rates and laws that will be in effect when the differences are expected to reverse. A valuation allowance is established when

necessary to reduce deferred tax assets to the amount expected to be realized.

The computation of limitations relating to the amount of such tax assets, and the determination of appropriate valuation allowances relating

to the realizability of such assets, are inherently complex and require the exercise of judgment. As additional information becomes available, we

continually assess the carrying value of our net deferred tax assets.

The Company applies the provisions of FASB Interpretation No. ("FIN") 48, Accounting for Uncertainty in Income Taxes—an

interpretation of FASB Statement No. 109 . Under FIN 48, the Company recognizes, in its consolidated financial statements, the impact of tax

positions that are more likely than not to be sustained upon examination based on the technical merits of the positions.

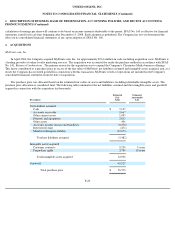

Net Income Per Share— Basic net income per share is computed using the weighted-

average number of common shares outstanding during

the period, net of shares subject to repurchase rights, and excludes any dilutive effects of options or warrants, restricted stock, restricted stock

units, and convertible securities, if any. Diluted net income per share is computed using the weighted-average number of common stock and

common stock equivalent shares outstanding (including the effect of restricted stock) during the period. Common stock equivalent shares are

excluded from the computation if their effect is antidilutive.

Legal Contingencies—

The Company is currently involved in certain legal proceedings. The Company records liabilities related to pending

litigation when an unfavorable outcome is probable and management can reasonably estimate the amount of loss. The Company does not record

liabilities for pending litigation when there are uncertainties related to assessing either the amount or the probable outcome of the claims asserted

in the litigation. As additional information becomes available, the Company continually assesses the potential liability related to such pending

litigation.

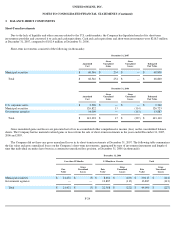

Segments— The Company complies with the reporting requirements of SFAS No. 131, Disclosures about Segments of an Enterprise and

Related Information

. The Company has modified its segment reporting structure during 2007 to establish Classmates Media as a separate

reportable operating segment in the place of the former Content & Media segment that no longer will be reported. The new Classmates Media

segment includes the Company's online social networking and online loyalty marketing operations, which had formerly been part of the

Content & Media segment. Web hosting and photo sharing, which also had formerly been part of the Content & Media segment, have been

moved to the Communications segment. In addition, the Company has eliminated its historical practice of separately reporting certain

unallocated corporate expenses. Under the new reporting structure, corporate expenses are allocated to the operating segments. The new segment

reporting structure is aligned with how management reviews and measures segment performance for internal reporting purposes in accordance

with the "management approach" defined in SFAS No. 131. All prior periods have been adjusted to conform to the current presentation.

Management has determined that segment

F-18