Classmates.com 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. DESCRIPTION OF BUSINESS, BASIS OF PRESENTATION, ACCOUNTING POLICIES, AND RECENT ACCOUNTING

PRONOUNCEMENTS (Continued)

Advertising and promotion expenses include media, agency and promotion expenses. Media production costs are expensed the first time the

advertisement is run. Media and agency costs are expensed over the period the advertising runs. Advertising and promotion expense for the years

ended December 31, 2007, 2006 and 2005 was $99.5 million, $117.7 million, and $159.5 million, respectively. At December 31, 2007 and 2006,

$1.3 million and $1.3 million, respectively, of prepaid advertising and promotion expense was included in other current assets in the

consolidated balance sheets.

Product Development Costs— Product development expenses include expenses for the maintenance of existing software and technology

and the development of new or improved software and technology, including personnel-related expenses for the software engineering

department and the costs associated with operating the Company's facility in India. Costs incurred by the Company to manage and monitor the

Company's product development activities are generally expensed as incurred, except for certain costs relating to the acquisition and

development of internal-use software that are capitalized and depreciated over their estimated useful lives, generally three years.

Software Development Costs— The Company accounts for cost incurred to develop software for internal use in accordance with Statement

of Position 98-1, Accounting for Costs of Computer Software Developed or Obtained for Internal Use , which requires such costs be capitalized

and amortized over the estimated useful life of the software. We capitalize costs associated with customized internal-use software systems that

have reached the application development stage. Such capitalized costs include external direct costs utilized in developing or obtaining the

applications and payroll and payroll-related expenses for employees who are directly associated with the applications. Capitalization of such

costs begins when the preliminary project stage is complete and ceases at the point in which the project is substantially complete and ready for

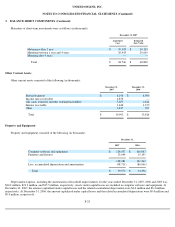

its intended purpose. The Company capitalized costs associated with internal-use software of $8.4 million and $9.1 million in the years ended

December 31, 2007 and 2006, respectively, which are being depreciated on a straight-line basis over each project's estimated useful life which is

generally three years. Capitalized internal-use software is included within the computer software and equipment category within property and

equipment, net, in the consolidated balance sheets.

General and Administrative— General and administrative expenses include personnel-

related expenses for executive, finance, legal, human

resources, facilities, and internal customer support personnel. In addition, general and administrative expenses include professional fees for legal,

accounting and financial services; office relocation costs; non-income taxes; insurance; occupancy and other overhead-related costs; and

expenses incurred and credits received as a result of certain legal settlements.

Stock-Based Compensation— On January 1, 2006, the Company adopted SFAS No. 123R (revised 2004), Share-Based Payment , which

requires the measurement and recognition of compensation expense for all share-based payment awards made to employees and directors

including employee stock options, stock awards and employee stock purchases related to the Company's employee stock purchase plan based on

the grant-date fair values of the awards. SFAS No. 123R supersedes the Company's previous accounting under Accounting Principles Board

("APB") Opinion No. 25, Accounting for Stock Issued to Employees . In March 2005, the SEC issued Staff Accounting Bulletin ("SAB")

No. 107 relating to SFAS No. 123R. The Company has applied the provisions of SAB No. 107 in its adoption of SFAS No. 123R (see Note 5).

The Company adopted SFAS No. 123R using the modified prospective transition method, and the Company's consolidated financial

statements at and for the years ended December 31, 2007 and 2006

F-15