Classmates.com 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

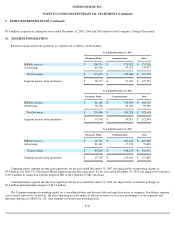

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

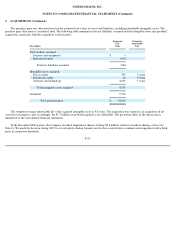

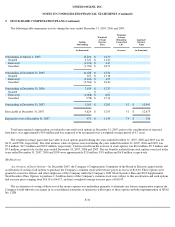

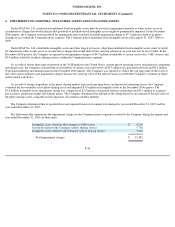

5. STOCK-BASED COMPENSATION PLANS (Continued)

effective January 1, 2006. The Company estimated this compensation expense, before tax, would have totaled approximately $3.8 million over

the course of the original vesting periods. Ninety-

five percent of the options would have vested within approximately 1.5 years from the effective

date of the acceleration with the remaining 5% vesting within approximately 2.5 years from the date of acceleration. The Company also believed

that because the options to be accelerated had exercise prices in excess of the then-current market value of the Company's common stock, the

options had limited economic value and were not fully achieving their original objective of incentive compensation and employee retention.

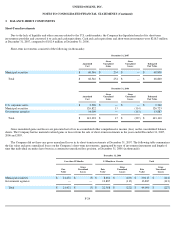

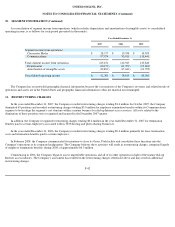

Tender Offer— In March 2006, the Company offered eligible employees of the Company the opportunity to exchange any outstanding

stock options granted to them, which had an exercise price per share of the Company's common stock at or above $16.00 (the "Eligible Options")

in return for restricted stock units. The exchange offer expired in April 2006, and approximately 1.8 million shares of common stock underlying

the Eligible Options were exchanged for restricted stock units covering approximately 0.4 million shares of common stock in exchange for the

cancellation of the Eligible Options. The exchange was offered to 315 eligible employees and was accounted for as a modification under SFAS

No. 123R in the June 2006 quarter. The number of restricted stock units that were issued in exchange for each tendered Eligible Option was

based on the per share exercise price of that option and was, in all events, less than the number of shares subject to the tendered option. Eligible

Options with exercise prices between $16.00 and $20.00 were exchanged based on a ratio of one restricted stock unit for four Eligible Options.

Eligible Options with exercise prices greater than $20.00 were exchanged based on a ratio of one restricted stock unit for five Eligible Options.

Total expense associated with the exchange, prior to the consideration of expected forfeitures, was approximately $0.8 million.

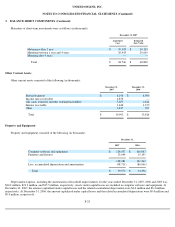

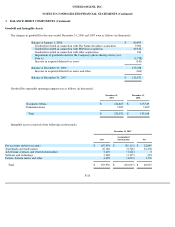

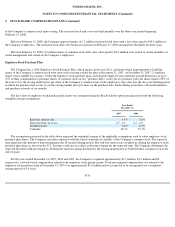

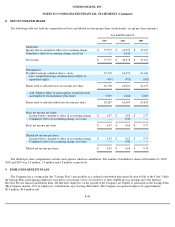

Restricted Stock and Restricted Stock Units

In January 2004, the Company granted 575,000 restricted shares of common stock with a weighted-average grant date fair value of $19.91.

In January 2005, 100,000 of these shares were canceled, and in June 2007, an additional 125,000 of these shares were canceled due to the

resignation of a former executive officer. At December 31, 2007, 350,000 restricted shares of common stock were outstanding. The restricted

shares vested entirely at the end of the four-year vesting period in January 2008, at which time approximately 142,000 shares were withheld and

employee withholding taxes of $1.5 million were paid.

F-33