Classmates.com 2007 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

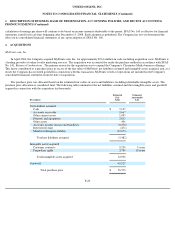

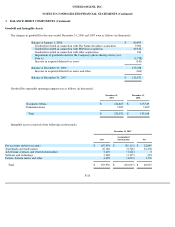

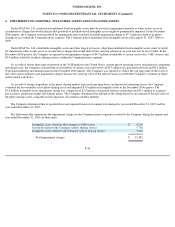

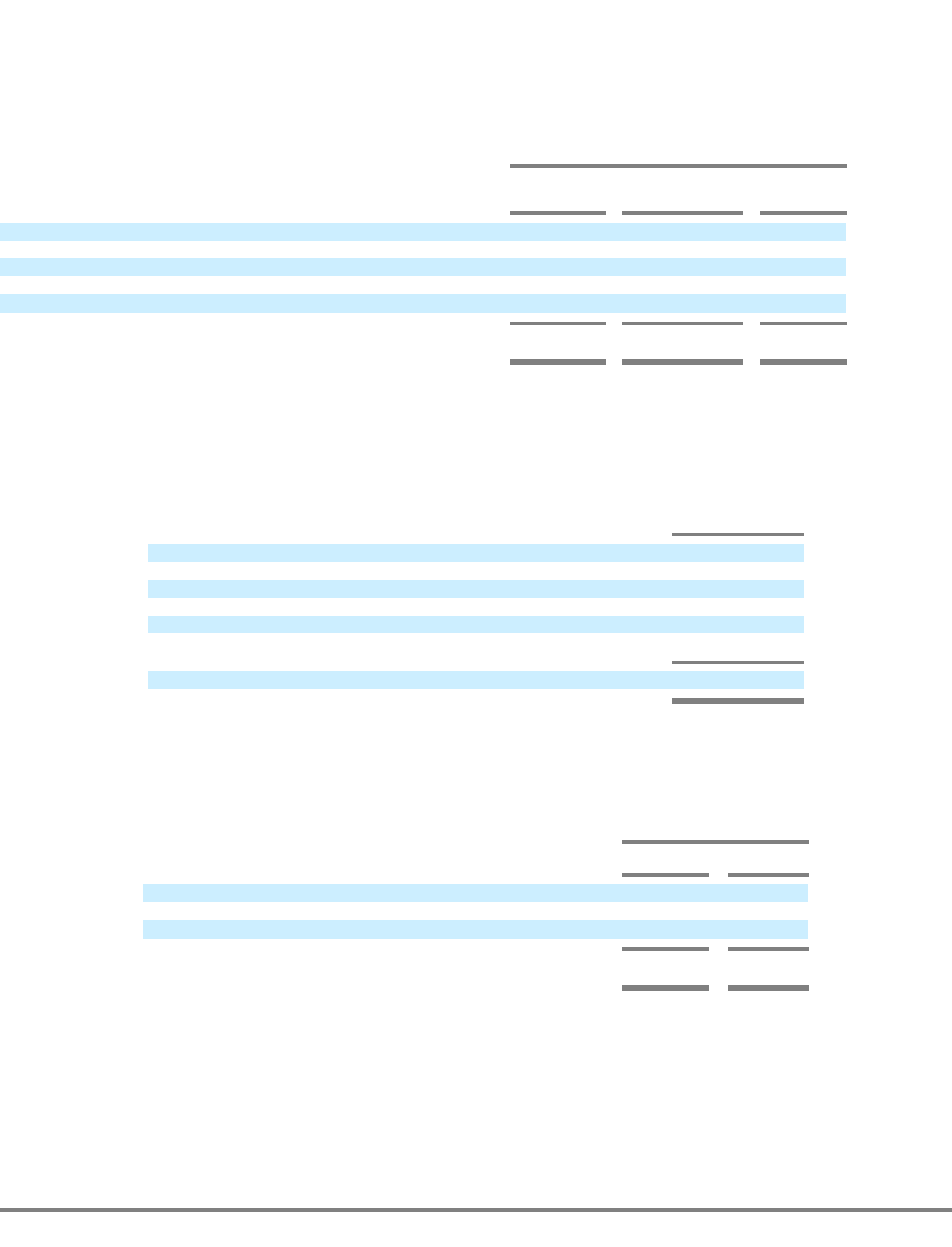

3. BALANCE SHEET COMPONENTS (Continued)

Amortization expense related to intangible assets for the years ended December 31, 2007, 2006 and 2005 was $12.8 million, $17.6 million,

and $21.8 million, respectively.

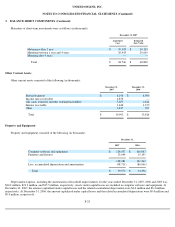

Estimated future intangible asset amortization expense at December 31, 2007 is as follows (in thousands):

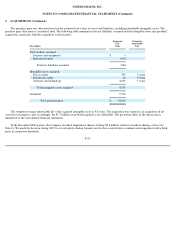

Accrued Liabilities

Accrued liabilities consisted of the following (in thousands):

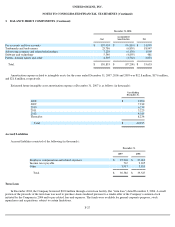

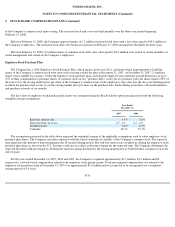

Term Loan

In December 2004, the Company borrowed $100 million through a term loan facility (the "term loan") dated December 3, 2004. A small

portion of the proceeds of the term loan was used to purchase shares tendered pursuant to a tender offer of the Company's common stock

initiated by the Company in 2004 and to pay related fees and expenses. The funds were available for general corporate purposes, stock

repurchases and acquisitions, subject to certain limitations.

F-27

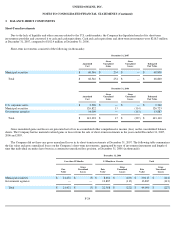

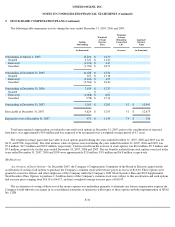

December 31, 2006

Cost

Accumulated

Amortization

Net

Pay accounts and free accounts

$

107,903

$

(76,810

)

$

31,093

Trademarks and trade names

25,786

(6,839

)

18,947

Advertising contracts and related relationships

7,229

(6,130

)

1,099

Software and technology

5,340

(4,859

)

481

Patents, domain names and other

4,595

(2,562

)

2,033

Total

$

150,853

$

(97,200

)

$

53,653

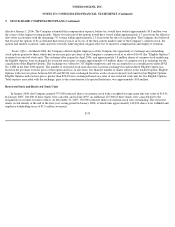

Year Ending

December 31,

2008

$

9,290

2009

7,912

2010

6,239

2011

5,225

2012

4,015

Thereafter

8,234

Total

$

40,915

December 31,

2007

2006

Employee compensation and related expenses

$

25,902

$

27,061

Income taxes payable

767

9,305

Other

3,917

3,181

Total

$

30,586

$

39,547