Classmates.com 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

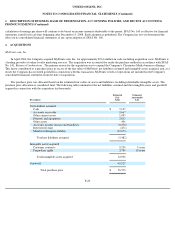

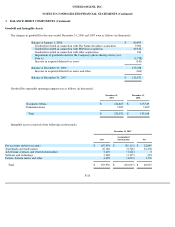

3. BALANCE SHEET COMPONENTS

Short-Term Investments

Due to the lack of liquidity and other concerns related to the U.S. credit markets, the Company has liquidated much of its short-term

investments portfolio and converted it to cash and cash equivalents. Cash and cash equivalents and short-term investments were $218.3 million

at December 31, 2007, compared to $162.4 million at December 31, 2006.

Short-term investments consisted of the following (in thousands):

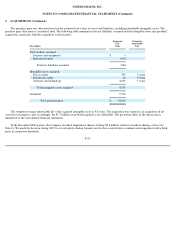

Gross unrealized gains and losses are presented net of tax in accumulated other comprehensive income (loss) on the consolidated balance

sheets. The Company had no material realized gains or losses from the sale of short-term investments in the years ended December 31, 2007,

2006 and 2005.

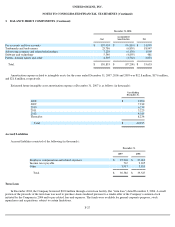

The Company did not have any gross unrealized losses in its short-term investments at December 31,

2007. The following table summarizes

the fair value and gross unrealized losses on the Company's short-term investments, aggregated by type of investment instrument and length of

time that individual securities have been in a continuous unrealized loss position, at December 31, 2006 (in thousands):

F-24

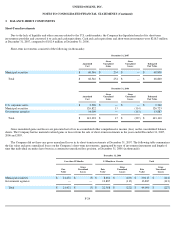

December 31, 2007

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

Municipal securities

$

68,546

$

254

$

—

$

68,800

Total

$

68,546

$

254

$

—

$

68,800

December 31, 2006

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Estimated

Fair Value

U.S. corporate notes

$

2,500

$

—

$

—

$

2,500

Municipal securities

126,822

15

(114

)

126,723

Government agencies

14,000

—

(

113

)

13,887

Total

$

143,322

$

15

$

(227

)

$

143,110

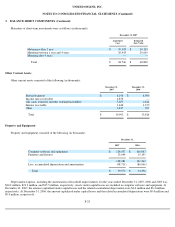

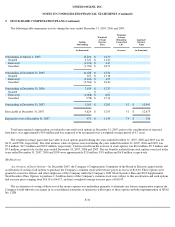

December 31, 2006

Less than 12 Months

12 Months or Greater

Total

Fair

Value

Gross

Unrealized

Losses

Fair

Value

Gross

Unrealized

Losses

Fair

Value

Gross

Unrealized

Losses

Municipal securities

$

21,432

$

(5

)

$

8,681

$

(109

)

$

30,113

$

(114

)

Government agencies

—

—

13,887

(113

)

13,887

(113

)

Total

$

21,432

$

(5

)

$

22,568

$

(222

)

$

44,000

$

(227

)