Classmates.com 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

2. ACQUISITIONS (Continued)

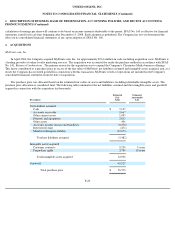

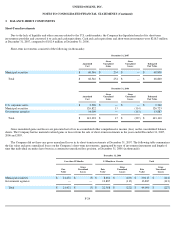

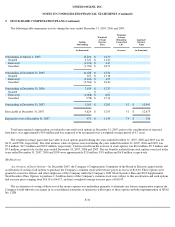

The purchase price was allocated based on the estimated fair values of assets and liabilities, including identifiable intangible assets. The

purchase price allocation is considered final. The following table summarizes the net liabilities assumed and the intangible assets and goodwill

acquired in connection with the acquisition (in thousands):

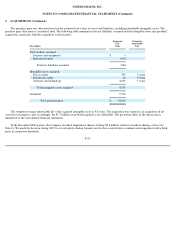

The weighted-

average amortizable life of the acquired intangible assets is 6.6 years. The $9.1 million of goodwill acquired is not deductible

for tax purposes. The pro forma effect of the transaction is immaterial to the consolidated financial statements.

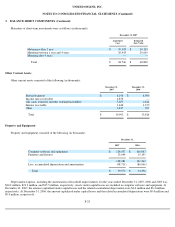

PhotoSite

In March 2005, the Company acquired certain assets related to PhotoSite, an online digital photo sharing service for approximately

$10.1 million in cash, including acquisition costs, and entered into a related licensing and support agreement with the seller. The acquisition was

accounted for under the purchase method in accordance with SFAS No. 141. The primary reason for the acquisition was to acquire PhotoSite's

software and services to enhance the Company's other services and to expand the Company's subscription offerings. This factor contributed to a

purchase price in excess of the fair value of PhotoSite's net liabilities assumed and intangible assets acquired, and, as a result, the Company has

recorded goodwill in connection with this transaction.

F-22

Description

Estimated

Fair

Value

Estimated

Amortizable

Life

Net liabilities assumed:

Cash

$

510

Accounts receivable

51

Accounts payable and accrued liabilities

(8

)

Deferred revenue

(541

)

Deferred income taxes

(545

)

Total net liabilities assumed

(533

)

Intangible assets acquired:

Pay accounts

500

4 years

Free accounts

600

10 years

Advertising contracts and related relationships

29

2 years

Technology

245

5 years

Proprietary rights

134

5 years

Other intangible assets

45

5 years

Total intangible assets acquired

1,553

Goodwill

9,092

Total purchase price

$

10,112