Classmates.com 2007 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

3. BALANCE SHEET COMPONENTS (Continued)

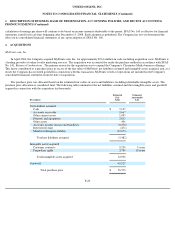

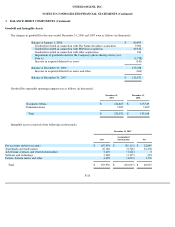

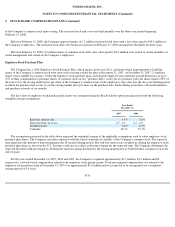

Maturities of short-term investments were as follows (in thousands):

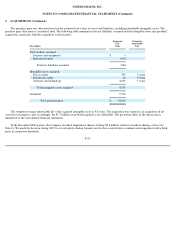

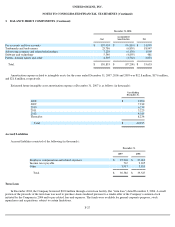

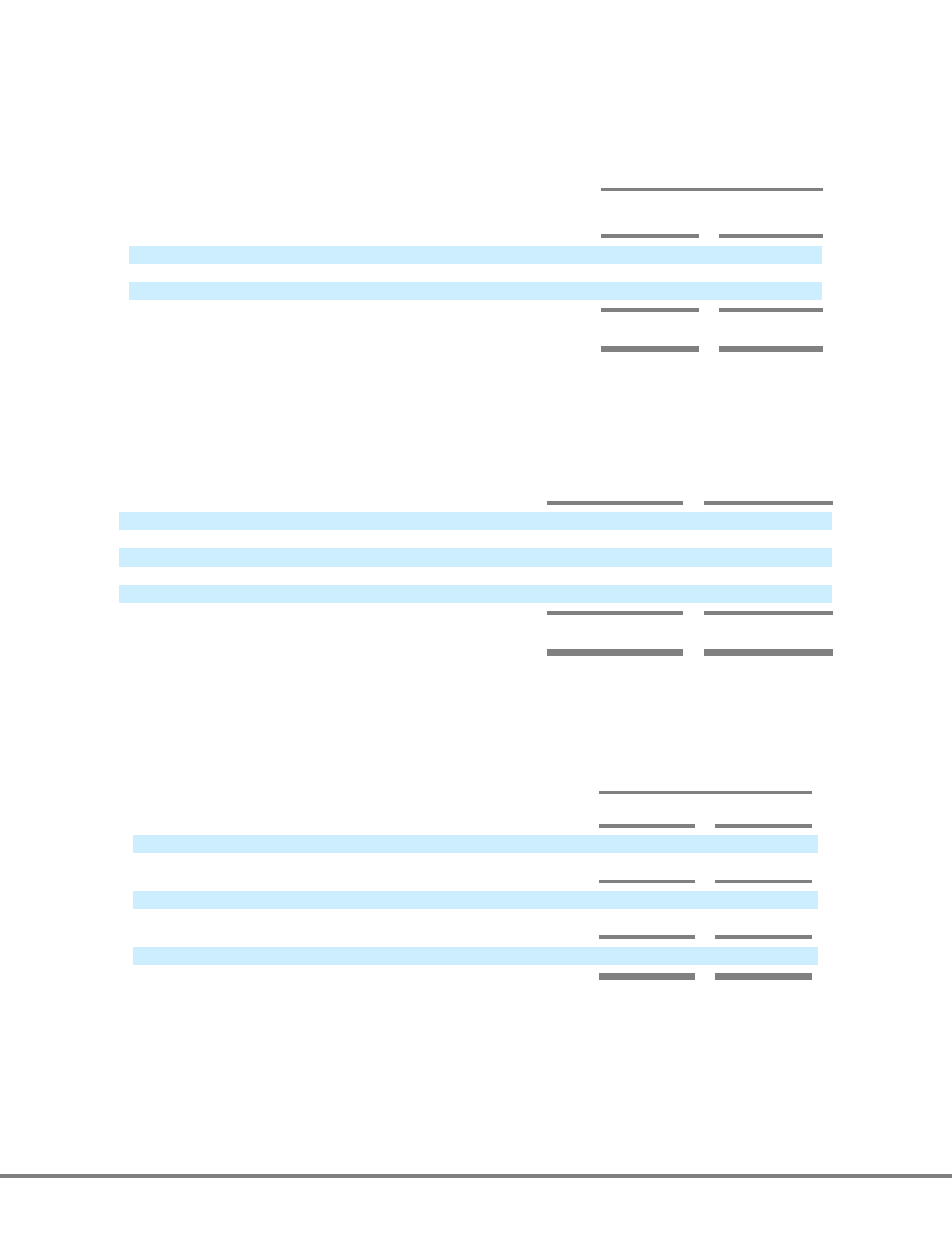

Other Current Assets

Other current assets consisted of the following (in thousands):

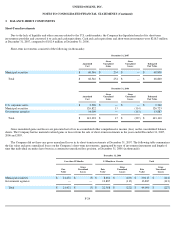

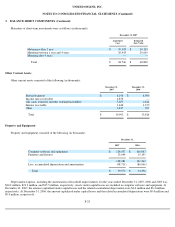

Property and Equipment

Property and equipment consisted of the following (in thousands):

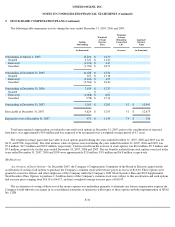

Depreciation expense, including the amortization of leasehold improvements, for the years ended December 31, 2007, 2006 and 2005 was

$20.2 million, $21.3 million, and $15.5 million, respectively. Assets under capital leases are included in computer software and equipment. At

December 31, 2007, the amount capitalized under capital leases and the related accumulated depreciation were $0.4 million and $0.4 million,

respectively. At December 31, 2006, the amount capitalized under capital leases and the related accumulated depreciation were $0.4 million and

$0.4 million, respectively.

F-25

December 31, 2007

Amortized

Cost

Estimated

Fair Value

Maturing within 1 year

$

39,103

$

39,135

Maturing between 1 year and 4 years

29,443

29,665

Maturing after 4 years

—

—

Total

$

68,546

$

68,800

December 31,

2007

December 31,

2006

Prepaid expenses

$

8,198

$

8,696

Income taxes receivable

4,878

—

Gift cards related to member redemption liability

3,653

2,644

Interest receivable

1,448

1,379

Other

1,815

707

Total

$

19,992

$

13,426

December 31,

2007

2006

Computer software and equipment

$

124,637

$

106,067

Furniture and fixtures

13,644

15,195

138,281

121,262

Less: accumulated depreciation and amortization

(98,711

)

(86,966

)

Total

$

39,570

$

34,296