Classmates.com 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Based on our current projections, we expect to continue to generate positive cash flows from operations, at least in the near term. We intend

to use our existing cash balances and future cash generated from operations to fund, among other things, dividend payments, if declared by our

Board of Directors; to develop and acquire other services, businesses or technologies; to repurchase shares of our common stock if we believe

market conditions to be favorable and it to be in our strategic interests; to repurchase our common stock underlying restricted stock units and pay

the employee withholding taxes due on vested restricted stock units; and to fund future capital expenditures. We currently anticipate that our

future cash flows from operations and existing cash, cash equivalent and short-term investments balances will be sufficient to fund our

operations over the next year, and in the near term we do not anticipate the need for additional financing to fund our operations. However, we

may raise debt or equity capital for a variety of reasons including, without limitation, developing new or enhancing existing services or products,

repurchasing our common stock, acquiring other services, businesses or technologies or funding significant capital expenditures. If we need to

raise capital through public or private debt or equity financings, strategic relationships or other arrangements, this capital might not be available

to us in a timely manner, on acceptable terms, or at all. Our failure to raise sufficient capital when needed could have a material adverse effect on

our business, financial position, results of operations, and cash flows, and could impair our ability to pay future dividends, if declared by our

Board of Directors. If additional funds were raised through the issuance of equity or convertible debt securities, the percentage of stock owned

by the then-current stockholders could be reduced. Furthermore, such equity or debt securities that we issue might have rights, preferences or

privileges senior to holders of our common stock.

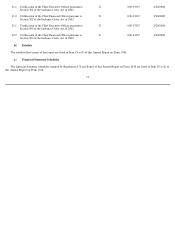

Year Ended December 31, 2006 compared to Year Ended December 31, 2005

Net cash provided by operating activities decreased by $35.6 million, or 26%, for the year ended December 31, 2006 compared to the year

ended December 31, 2005. Cash provided by operating activities is driven by our net income adjusted for non-cash items, including depreciation

and amortization, stock-based compensation, impairment of goodwill, intangible assets and long-lived assets, deferred taxes, tax benefits from

equity awards, and changes in operating assets and liabilities. The year-over-year decrease was primarily the result of the following:

•

a $2.3 million increase in other items including a $1.0 million increase in cash paid for legal settlements and a $0.9 million

increase in net amortization on short-term investments; and

•

a $37.7 million unfavorable operating assets and liabilities change, including a $28.9 million decrease in accounts payable and

accrued liabilities, a $6.2 million decrease in deferred revenue primarily due to decreases in Internet access pay accounts, a

$2.3 million decrease in other liabilities, a $1.6 million increase in accounts receivable, and a $1.0 million increase in other assets.

The unfavorable operating assets and liabilities change was partially offset by an increase of $2.3 million in the member

redemption liability related to our loyalty marketing service, which we acquired in April 2006.

The negative impact on working capital from the change in accounts payable and accrued liabilities balances was due to a $9.1 million year-

over-year reduction in the change in income taxes payable; a $9.0 million year-over-year reduction in the change in accrued employee bonuses

due to the timing of bonus payments, including the payment of bonuses associated with the MyPoints acquisition; a $5.2 million year-over-year

reduction in the change in sales and marketing accruals primarily due to a reduction in media and other advertising costs associated with our

Communications segment; and a net year-over-

year reduction in other payables and accrued liabilities primarily due to the timing of payments to

vendors.

64