Classmates.com 2007 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

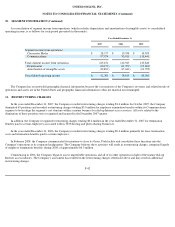

12. SUBSIDIARY INITIAL PUBLIC OFFERING OF CLASSMATES MEDIA CORPORATION

In May 2007, the Company announced its intention to explore the possibility of a subsidiary IPO. CMC was formed in August 2007 for the

purposes of consolidating our Classmates, The Names Database and MyPoints business units and initiating a public equity offering. The

businesses were contributed to CMC by the Company on August 9, 2007. In August 2007, CMC filed a Form S-1 registration statement with the

SEC for the IPO of its common stock.

In December 2007, the Company determined that proceeding with the IPO under then-current market conditions was not in the best

interests of its stockholders and the Company withdrew CMC's Form S-1 registration statement previously filed with the SEC. Approximately

$0.5 million of transaction costs were determined not to have continuing value after the withdrawal of the IPO and were expensed in the quarter

ended December 31, 2007. It remains the Company's strategy to complete an IPO of CMC. As such, certain additional IPO transaction-related

costs totaling $3.6 million associated with the IPO have been deferred and are included in other assets on the Company's consolidated balance

sheet at December 31, 2007. If the Company does not proceed with this strategy, these deferred costs will be expensed and included in the

Classmates Media segment operating results as well as in the Company's consolidated statements of operations in a future period.

13. COMMITMENTS AND CONTINGENCIES

Leases

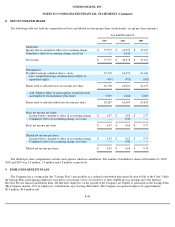

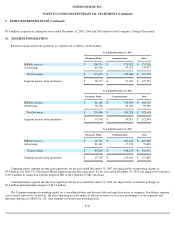

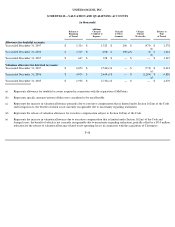

Future minimum lease payments at December 31, 2007 under noncancellable capital and operating leases, and related sublease income,

with initial lease terms in excess of one year, are as follows:

(1)

Year Ending December 31,

2008

2009

2010

2011

2012

Thereafter

Total

Capital leases(1)

$

14

$

—

$

—

$

—

$

—

$

—

$

14

Operating leases

12,087

11,365

7,194

4,942

4,486

7,758

47,832

Operating sublease income

(1,086

)

(1,113

)

(424

)

—

—

—

(

2,623

)

Total

$

11,015

$

10,252

$

6,770

$

4,942

$

4,486

$

7,758

$

45,223

Includes $1,000 of imputed interest.

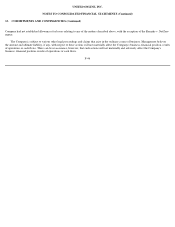

Operating leases consist primarily of facility leases. The Company leases its facilities and certain operating equipment under operating

leases expiring at various periods through 2014. Certain of the Company's operating leases include rent holidays as well as escalation clauses

that periodically adjust rental expense to reflect changes in price. The Company records rent expense on a straight-line basis over the lease term.

Rental expense for operating leases for the years ended December 31, 2007, 2006 and 2005 was $7.4 million, $6.6 million and $6.5 million,

respectively.

Standby Letters of Credit

Standby letters of credit are maintained pursuant to certain of the Company's lease arrangements. The standby letters of credit remain in

effect at declining levels through the terms of the related leases. Certificates of deposit of $2.1 million and $1.7 million maintained by the

Company in connection with certain of these standby letters of credit are included in other current assets and other assets in the

F-43