Classmates.com 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

UNITED ONLINE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

7. INCOME TAXES (Continued)

regarding realization; (4) the re-measurement of deferred tax assets in New York; (5) employee stock purchase plan compensation, the benefit of

which is not currently recognized under SFAS No. 123R but which is recognized upon a disqualified disposition; and (6) the benefit of federal

tax exempt interest income.

For the year ended December 31, 2005, the Company recorded a tax provision of $40.2 million on pre-tax income of $87.4 million,

resulting in an effective tax rate of 46.1%. The effective tax rate differs from the statutory federal income tax rate primarily due to (1) state

income taxes, net of federal benefit; (2) compensation, including stock-based compensation, that is limited under Section 162(m) of the Code;

(3) foreign losses, the benefit of which is not currently recognizable due to uncertainty regarding realization; and (4) the re-measurement of

deferred tax assets, including a change in New York State tax law.

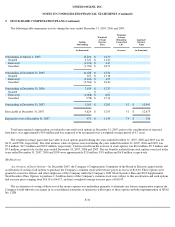

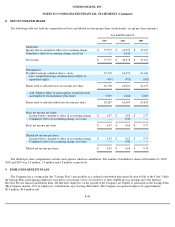

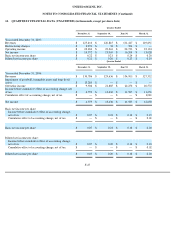

Components of net deferred tax assets at December 31, 2007 and 2006 are as follows (in thousands):

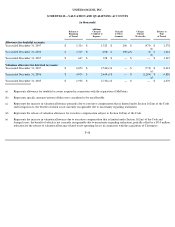

The Company has a valuation allowance of approximately $8.6 million at December 31, 2007 to reduce deferred tax assets to the amount

that is more likely than not to be realized in future periods. Based on the Company's assessment of all available evidence, it concluded that,

primarily with the exception of certain compensation that is expected to be limited under Section 162(m) of the Code and foreign losses due to

uncertainty regarding utilization, it is more likely than not that the remaining deferred tax assets will be realized. The valuation allowance is

primarily attributable to certain

F-38

December 31,

2007

2006

Deferred tax assets:

Net operating loss carryforwards

$

62,743

$

66,303

Depreciation and amortization

2,429

7,899

Stock

-

based compensation

10,411

8,841

Other

8,042

8,719

Total gross deferred tax assets

83,625

91,762

Less: valuation allowance

(8,623

)

(6,850

)

Total deferred tax assets after valuation allowance

75,002

84,912

Deferred tax liabilities:

Amortization of acquired intangible assets

(10,393

)

(13,552

)

Total deferred tax liabilities

(10,393

)

(13,552

)

Net deferred tax assets

$

64,609

$

71,360

December 31,

2007

2006

Current portion of net deferred tax assets

$

7,050

$

11,705

Long

-

term portion of net deferred tax assets

57,559

59,655

Net deferred tax assets

$

64,609

$

71,360