Classmates.com 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER

PURCHASES OF EQUITY SECURITIES

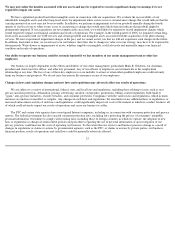

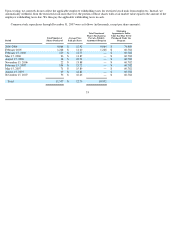

Our common stock has been quoted on the Nasdaq Stock Market ("NASDAQ") under the symbol "UNTD" since September 26, 2001. Prior

to that, NetZero common stock had been quoted on the NASDAQ under the symbol "NZRO" since September 23, 1999. The following table sets

forth, for the quarters indicated, the high and low sales prices per share of our common stock as reported on the NASDAQ.

On February 8, 2008, there were 969 holders of record of our common stock.

Dividends

Our Board of Directors declared quarterly cash dividends of $0.20 per share of our common stock in February 2006, May 2006, August

2006, and November 2006 which were paid on February 28, 2006, May 31, 2006, August 31, 2006, and November 30, 2006 and totaled

$12.9 million, $13.4 million, $13.5 million, and $13.7 million, respectively.

Our Board of Directors declared quarterly cash dividends of $0.20 per share of our common stock in February 2007, April 2007, July 2007,

and October 2007 which were paid on February 28, 2007, May 31, 2007, August 31, 2007, and November 30, 2007 and totaled $13.7 million,

$14.4 million, $14.4 million, and $14.6 million, respectively.

In January 2008, our Board of Directors declared a quarterly cash dividend of $0.20 per share of our common stock. The record date for the

dividend was February 14, 2008 and is payable on February 29, 2008.

The payment of future dividends is discretionary and is subject to determination by our Board of Directors each quarter following its review

of our financial performance. Dividends are declared and paid out of our surplus, as defined and computed in accordance with the General

Corporation Law of the State of Delaware.

Common Stock Repurchases

In May 2001, our Board of Directors authorized a common stock repurchase program (the "program") that allows us to repurchase shares of

our common stock through open market or privately negotiated transactions based on prevailing market conditions and other factors. From time

to time, our Board of Directors has increased the amount authorized for repurchase under this program and has extended the program. In April

2004, our Board of Directors authorized us to purchase up to an additional $100 million of our common stock under the program, bringing the

total amount authorized under the program to $200 million. In January 2008, our Board again further extended the program through

December 31, 2008. At December 31, 2007, we had repurchased $139.2 million of our common stock under the program, leaving $60.8 million

of authorization remaining under the program.

Shares withheld upon vesting of restricted stock units to pay applicable employee withholding taxes are considered common stock

repurchases, but are not counted as purchases against the program.

32

2006

2007

High

Low

High

Low

First Quarter

$

15.40

$

11.22

$

14.68

$

12.55

Second Quarter

$

13.68

$

10.79

$

17.46

$

13.77

Third Quarter

$

12.37

$

10.05

$

17.27

$

10.85

Fourth Quarter

$

14.04

$

12.02

$

17.97

$

11.03