Classmates.com 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Classmates.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

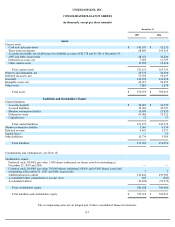

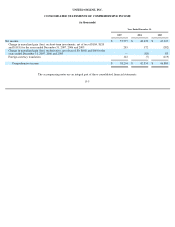

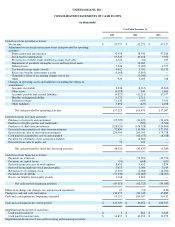

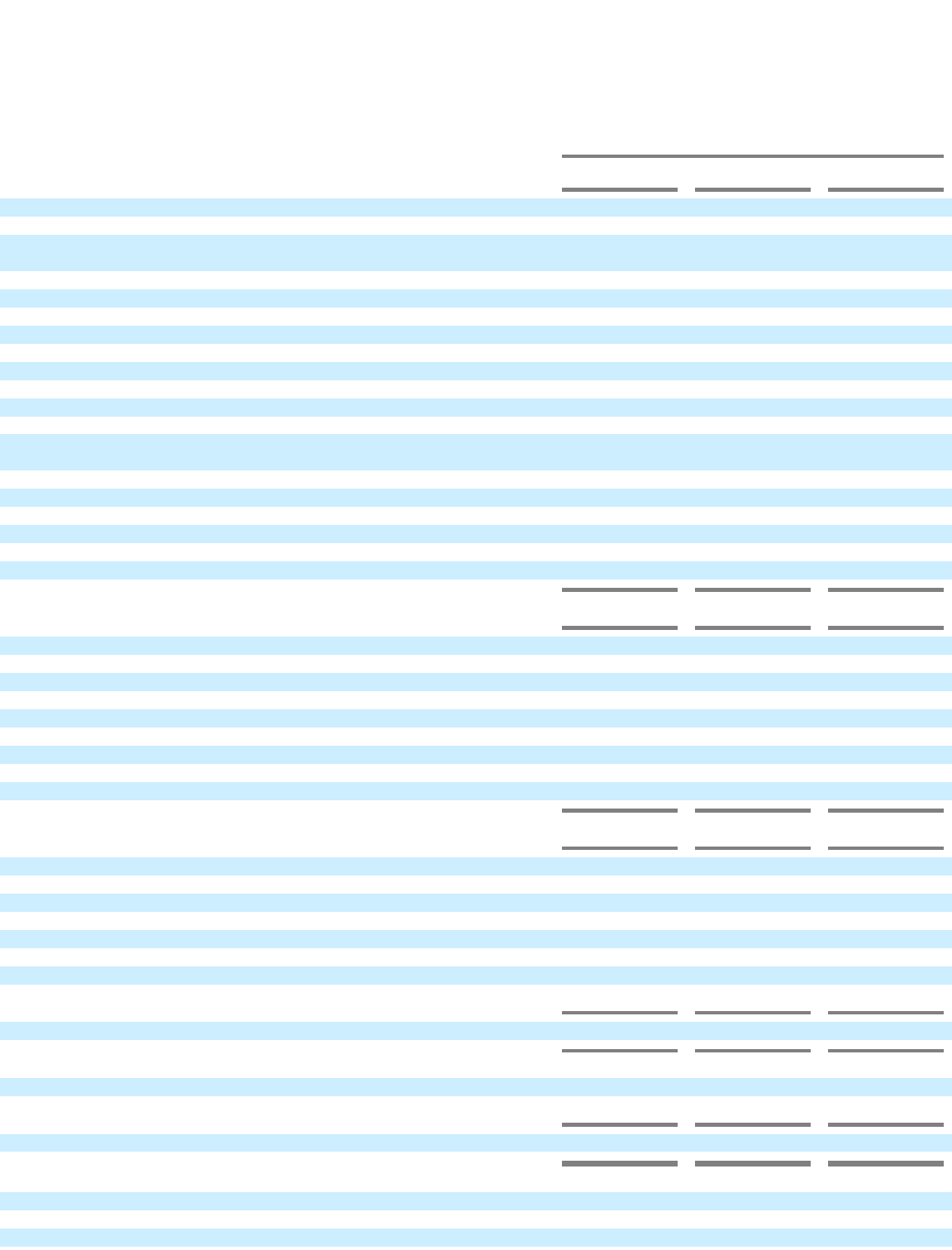

UNITED ONLINE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

Year Ended December 31,

2007

2006

2005

Cash flows from operating activities:

Net income

$

57,777

$

42,272

$

47,127

Adjustments to reconcile net income to net cash provided by operating

activities:

Depreciation and amortization

32,950

38,930

37,280

Stock

-

based compensation

19,549

19,168

9,952

Provision for (benefit from) doubtful accounts receivable

1,323

(81

)

633

Impairment of goodwill, intangible assets and long

-

lived assets

—

13,285

—

Deferred taxes

7,248

(3,609

)

1,577

Tax benefits from equity awards

4,622

5,781

15,170

Excess tax benefits from equity awards

(3,168

)

(3,863

)

—

Cumulative effect of accounting change, net of tax

—

(

1,041

)

—

Other

929

3,023

748

Changes in operating assets and liabilities (excluding the effects of

acquisitions):

Accounts receivable

2,138

(3,215

)

(2,302

)

Other assets

(9,018

)

844

1,806

Accounts payable and accrued liabilities

(9,025

)

(11,211

)

17,677

Member redemption liability

4,572

2,315

—

Deferred revenue

11,430

(999

)

5,181

Other liabilities

5,898

(129

)

2,198

Net cash provided by operating activities

127,225

101,470

137,047

Cash flows from investing activities:

Purchases of property and equipment

(25,509

)

(24,329

)

(21,653

)

Purchases of rights, patents and trademarks

—

(

509

)

(5,562

)

Purchases of short

-

term investments

(228,920

)

(324,328

)

(320,869

)

Proceeds from maturities of short

-

term investments

72,890

115,581

177,595

Proceeds from sales of short

-

term investments

229,994

209,599

175,738

Cash paid for acquisitions, net of cash acquired

—

(

61,155

)

(8,638

)

Payment for settlement of pre

-

acquisition liability

—

(

4,800

)

—

Proceeds from sales of assets, net

71

104

—

Net cash provided by (used for) investing activities

48,526

(89,837

)

(3,389

)

Cash flows from financing activities:

Payments on term loan

—

(

54,209

)

(45,792

)

Payments on capital leases

(16

)

(668

)

(621

)

Proceeds from exercises of stock options

8,605

9,452

5,874

Proceeds from employee stock purchase plan

5,413

5,004

3,169

Repurchases of common stock

(5,601

)

(2,684

)

(14,206

)

Payments for dividends

(57,130

)

(53,483

)

(38,067

)

Excess tax benefits from equity awards

3,168

3,863

—

Net cash used for financing activities

(45,561

)

(92,725

)

(89,643

)

Effect of exchange rate changes on cash and cash equivalents

65

(53

)

(130

)

Change in cash and cash equivalents

130,255

(81,145

)

43,885

Cash and cash equivalents, beginning of period

19,252

100,397

56,512

Cash and cash equivalents, end of period

$

149,507

$

19,252

$

100,397

Supplemental disclosure of cash flows:

Cash paid for interest

$

2

$

862

$

4,245

Cash paid for income taxes

$

34,855

$

34,352

$

13,970

Supplemental disclosure of non

-

cash investing and financing activities: